ACO Cost and MACRA Implementation Survey

May 2016

Dear ACO Colleague:

We are pleased to release the results of our sixth ACO survey, the first in a full report format. This survey is extremely timely, as it focuses on ACO operational costs, ACOs’ ability to take on downside risk, and the current proposed rule for the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

As you know, ACOs are commonly seen as the vehicle that can bring together various value and quality improvement initiatives to provide a seamless, patient-centered experience for the populations they serve. In the absence of ACOs, or ACO-like entities, healthcare organizations may use a patchwork approach to value and quality initiatives on top of a fee-for-service system that is rooted in the way things have always been done. ACOs are trail blazers and risk takers, and, above all, ACOs want to see an improved healthcare system for the patients and communities in which they live.

Although the ACO model holds great promise, recent policy decisions could significantly undercut the ability of ACOs to flourish individually and collectively. Sadly, the survey findings in this report indicate that many ACOs are under enormous pressure from the significant operational investments combined with unfavorable policies. Should policies remain on the current trajectory, this model may decline over time leading to the end of ACOs as we see them today.

We find ourselves at a historic crossroads in health care. ACOs are on the cusp of so much potential, positive change moving health care towards quality and value. And yet, the speed of change has even the most seasoned policy insider rolling up their sleeves. In the midst of this moment of opportunity juxtaposed with challenge, we need to ensure that those providing care on the front lines are supported. ACOs may be willing to take on more risk over time and they show a willingness to do so, but the two-sided risk models currently offered by the Centers for Medicare & Medicaid Services (CMS) are untenable for many. We must work together to support ACOs and ensure their long term viability.

Clif Gaus

Chief Executive Officer

National Association of ACOs

Contents

Introduction

Methods

Survey Findings: ACO’s Investment

Survey Findings: ACOs and Risk

Survey Findings: ACOs and MACRA

Conclusion

Appendix: NAACOS ACO Cost and MACRA Survey Questions

Introduction

The Medicare Shared Savings Program (MSSP) is a key component of the Medicare delivery system reform initiatives included in the Patient Protection and Affordable Care Act. Accountable Care Organizations (ACOs) represent a new approach to the delivery of health care and were created to facilitate coordination and cooperation among providers to improve the quality of care and reduce unnecessary costs. As Medicare evolves from paying healthcare providers based on volume to value, the MSSP and other ACO models, such as Next Generation ACOs, will play a critical role in improving care for individuals, enhancing the health of populations, and slowing the growth rate of Medicare expenditures.

The Medicare Access and CHIP Reauthorization Act (MACRA) was passed in 2015, and a significant proposed rule implementing key provisions of MACRA was recently released by the Centers for Medicare & Medicaid Services (CMS) on April 27, 2016. This MACRA proposed rule represents significant changes to health care and ACOs in particular, from proposing what is, or is not, an eligible advanced Alternative Payment Model (APM) to detailing elements of the new Merit-Based Incentive Payment System (MIPS). MACRA represents one of the most important Medicare policy changes in recent history.

As ACOs are discussed under MACRA and other related healthcare policies, questions are commonly raised:

- How much are ACOs investing?

- How much and how quickly are ACOs able to take on two-sided risk?

- How do ACOs feel about Track 1 being excluded from the list of proposed Advanced APMs under MACRA?

To address these answers, the National Association of ACOs (NAACOS) conducted the ACO Cost and MACRA Implementation Survey during this historic time of change in healthcare to learn from the ACOs themselves— the “front line” healthcare organizations. Many of the ACOs surveyed have been in the MSSP from the beginning and have contributed to that program’s success. The program’s continued success cannot be achieved without listening to and understanding these important stakeholders.

“The last five years have seen the most positive delivery system improvements in our nation’s history, and we are committed to accelerating that progress. We want to test new models, learn what works, and scale successes rapidly. And we cannot and do not want to do this alone.” Dr. Patrick Conway, M.D., Acting Principal Deputy Administrator, Chief Medical Officer, and Director of the CMS Innovation Center The CMS blog

Methods

In the Spring of 2016, NAACOS emailed all MSSP ACOs, including NAACOS members and nonmembers, with information about the NAACOS ACO Cost and MACRA Implementation Survey. A link to an online survey, hosted through an online survey service, Survey Monkey, was sent to all MSSP participants. In addition, a manual survey was offered to organizations that provide administrative oversight to multiple ACOs since the online survey tool did not allow for more than response from an internet protocol (IP) address.

NAACOS, with support from a nationally recognized consulting firm, designed the survey questionnaire to collect meaningful information from ACOs about their operating costs, willingness to accept downside risk, and considerations under MACRA. The number and depth of questions was set to enable an ACO executive to complete the survey in less than an hour. For the operating cost questions, cost categories were designed to reflect the way that many ACOs organize their expenses for financial statements or other internal accounting purposes. ACOs that started between 2012 and 2015 were asked to submit data for calendar year 2015, and ACOs that started in 2016 were asked for budgeted 2016 costs. The survey was bifurcated so that MSSP Track 1 ACOs answered additional questions that were not applicable to other MSSP tracks. The complete survey questions can be found on pages 14-15.

Out of the 433 current MSSP ACOs that the survey was sent to, 144 unique ACOs completed the survey, giving a response rate of 33 percent. There were an additional 77 respondents who started the survey but did not finish (and were not calculated in the response rate). Once the survey was closed, the database was searched for potential multiple responses from a single ACO. There were seven duplicate responses found and those with the most thorough responses were kept in the survey and the duplicates removed.

About the survey respondents

The ACOs that completed the survey provide care in 40 different states, providing widespread geographical representation. The ACOs also represent a diverse perspective of ACO sizes, with assigned beneficiaries ranging from 5,000 to 80,000 with an average of 16,667 as seen in table 1 below.

Table 1, A look at the survey respondent’s geographical location and size of MSSP assigned beneficiaries.

| Survey respondents: | |

| Geographical location of the ACOs | 40 different states represented in the survey |

| Assigned beneficiaries to the ACOs | Average: 16,667; Range: 5,000 – 80,000 |

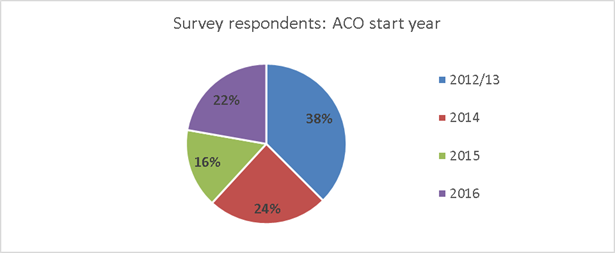

The survey also compares the different years that the ACOs started in the MSSP. In figure 1 below, 38 percent of the survey respondents began in 2012-2013, 24 percent in 2014, 16 percent in 2015, and 22 percent in 2016. Interestingly, the survey sample largely reflects the overall participation with all of the ACOs in the MSSP (2012/13, 34 percent; 2014, 23 percent; 2015, 20 percent; and 2016, 23 percent) from the 2016 MSSP data.

Figure 1, A look at the survey respondent’s ACO start year in the MSSP.

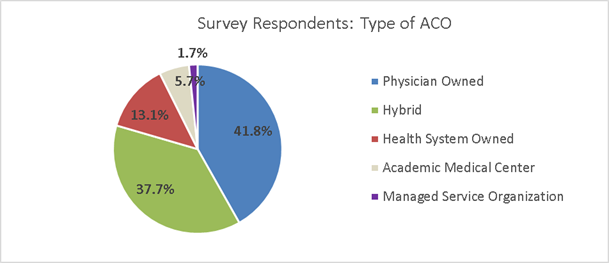

The majority (80 percent) of the survey respondents represent ACOs that have organizational structures that are either physician owned or a hybrid (a physician and hospital participating together as an ACO and the ACO is not owned by a healthcare system or academic medical center). As seen in figure 2 below, 41.8 percent of the ACOs are physician owned, 37.7 percent a hybrid, 13.1 percent owned by a health system, 5.7 percent are owned by an academic medical center, and 1.7 percent are managed service organizations. The ACO categorizations are based on market research, ACO tax identification number structure, internal governance, and shared savings distribution methodologies.

Figure 2, A look at the survey respondent’s ACO structural type.

he survey respondents were also broken into ACOs who are either independent entities or are part of a group with a centralized operations and other shared services among many ACOs. These two groups were categorized as single ACOs or Multi ACOs respectively, and were identified using a similar process as the ACO structural methodology described above. Out of the survey respondents, 70 percent represent single ACOs and 30 percent represent multi ACOs. As you will see in the report, the findings between these two groups are substantial.

Survey Findings: ACO’s Investment

“The investment risk is substantial (in our case $2.5 million per year) with no guarantee of any return. I call that risk.” ~Survey respondent

How much does it take to run an ACO?

This is an important question for which answers need to be better understood. For example, policy decisions are based on “what is a nominal risk,” and assumptions have been made that ACOs may not have much “skin in the game” if they are in a one-sided risk arrangement. Survey results in this report validate the what NAACOS hears from its members: “ACOs are the right thing to do, but the investment is extreme.”

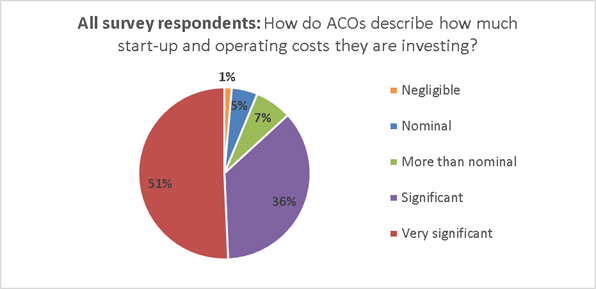

To better understand how much investment is needed from the ACOs themselves, survey respondents were asked to describe their start-up and ongoing operational costs. As seen in figure 3, just over half (51 percent) of the ACOs who responded said that the investment was very significant, 36 percent said it was significant, seven percent said it was more than nominal, five percent said nominal, and one percent said the investment was negligible.

Figure 3: Survey repsonse to the question: Which word or phrase best describes your perspective regarding the investments your ACO has made (including both start-up and ongoing operating costs) to participate in the MSSP.

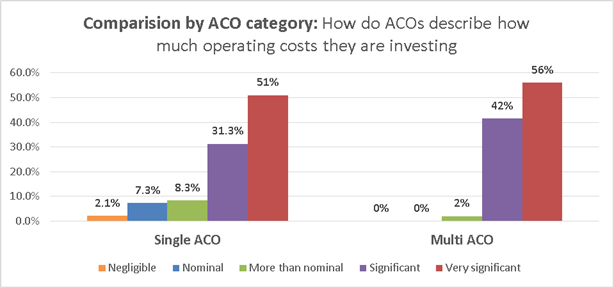

When looking at survey respondents of those part of a single ACO versus multi-ACO, or those who share centralized operations across many ACOs, the findings are interesting. As seen in figure 4, when comparing the investments to participate in the MSSP, 81.3 percent of the single ACOs indicated the investment to be significant or very significant where as 98 percent indicated the same for multi-ACOs. A little over half (51 percent) of single ACOs selected very significant to describe the investment to participate in the MSSP, 31.3 percent selected significant, 8.3 percent more than nominal, 7.3 percent nominal, and 2.1 percent negligible. Over half (56 percent) of multi-ACOs selected very significant, 42 percent significant, two percent more than nominal, and zero percent selected nominal or negligible.

Figure 4: Survey repsonse to the question: Which word or phrase best describes your perspective regarding the investments your ACO has made to participate in the MSSP.

When looking a little deeper into the operating costs, the survey asked the respondents to put a dollar amount to their recent estimated costs. Table 2 on the following page, shows the average operating costs, by common operational categories, provided by the survey respondents. Interestingly, the difference between the single and multi-ACOs is almost half. The average cost of single ACOs are almost two million ($1,943,276), whereas the average cost of multi-ACOs is almost one million ($974,289) and the average for all survey respondents is between both of those amounts at $1,622,032. The range across all of the survey respondents is significant, ranging from as low as $185,000 to as much as $9,500,000.

Table 2: Survey repsonses to the question: Provide estimated marginal operating costs attributable to your participation in the MSSP, all survey respondents compared to ACOs that are part of a single or multi-ACO.

|

Estimated ACO costs for participating in the MSSP, by all survey responses and ACO type: |

|||||

|

|

Clinical and care management |

Healthcare information technology, population analytics, and reporting |

ACO management, administration, financial, legal, and compliance |

Other (sum or all other operating costs) |

TOTAL |

|

Type: Single ACOs |

$772,020 |

$563,403 |

$479,781 |

$143,070 |

$1,943,276 |

|

Type: Multi-ACOs (centralized operations across many ACOs) |

$350,456 |

$351,305 |

$221,773 |

$80,656 |

$974,289 |

|

Averages of all survey responses |

$642,044 |

$501,300 |

$402,272 |

$121,115 |

$1,622,032 |

These numbers do not reflect the narrative that many ACOs provided explaining additional costs, which are challenging to separate from the cost of the health system that is making investments to move towards value across the system. For example, the electronic health record (EHR) is a tricky expenditure for ACOs to tease apart from the larger system; many of the respondents just left that category as zero, in fact. Another example is annual quality reporting for which the ACO often utilizes existing hospital staff and does not count as an expense against the ACO.

Survey Findings: ACOs and Risk

“With substantial investment in ACO infrastructure, CMS should be far more effective in supporting us through timely and accurate information. Attribution needs to be fixed. That being said, we feel forced to proceed.” ~Survey Respondent

How do ACOs view sharing losses?

Many ACOs see themselves as already sharing losses across their business lines, absorbing cost differentials between the expenses and reimbursement or absorbing costs of patients unable to pay. However, risk-based contracts typically involve detailed terms that are agreed upon by both parties prior to an agreement. The following findings indicate that most ACOs are willing to take on downside risk but they seek a more shared, not forced, agreement than what is currently offered in the MSSP.

*Note: Downside risk, as described in the survey questionnaire, means the ACO would be responsible for paying CMS for a portion of ACO beneficiary expenditures if the expenditures exceed the benchmark and the minimum loss rate.

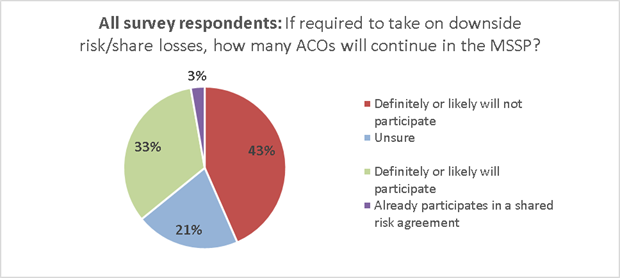

When asked how likely the ACO is to continue participating in the MSSP if CMS requires downside risk, ACOs were split on their answers. As reported in figure 5 below, 43 percent said they would leave the MSSP (definitely or likely will not participate), 21 percent were unsure, about a third (33 percent) would definitely or likely continue to participate, and three percent are already in a shared risk agreement (MSSP Track 2 or 3).

Figure 5: Survey repsonse to the question: How likely is your ACO to participate in the MSSP if CMS requires ACOs to share losses, all survey respondents.

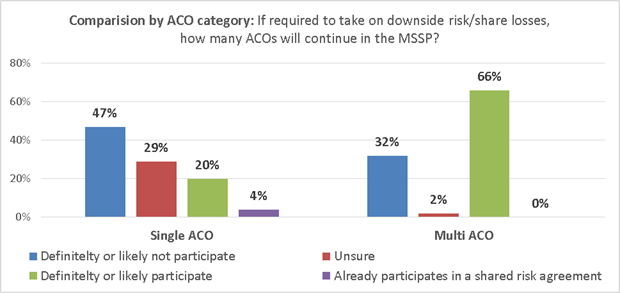

Interestingly, when looking at the survey responses by those who are part of a single ACO or multi-ACO (those who share centralized operations across many ACOs), the two groups differ in how they would continue in the MSSP if required to take downside risk. As seen in figure 6 on the following page, almost half (47 percent) of single ACOs would leave the program, about a third (29 percent) are unsure, 20 percent would stay, and four percent already are in a risk agreement. In contrast, about a third of multi-ACOs would leave the program, 66 percent plan to stay in the program, and two percent are unsure. The finding points to a potential that, of those who may leave the MSSP if required to take risk, the single ACOs may likely be the first to exit the program.

Figure 6: Survey repsonse to the question: How likely is your ACO to participate in the MSSP if CMS requires ACOs to share losses, comparing single and multi-ACO survey respondents.

Years till willing to share downside risk

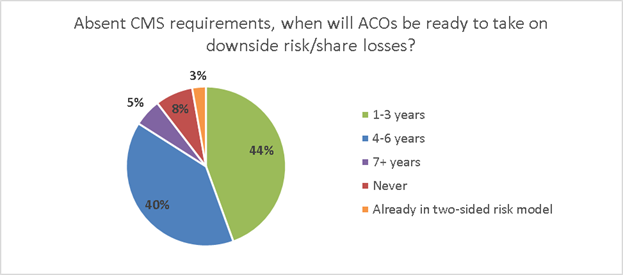

When asked in how many years an ACO would be willing to take on downside risk, 84 percent said within the next six years. In figure 7 below, 44 percent are ready within 1-3 years, 40 percent within 4-6 years, 5.5 percent said in seven or more years, 7.6 percent said they will never be ready to take on downside risk, and 2.8 percent said they are already in a two-sided risk model (MSSP Track 2 or 3).

Figure 7: Survey repsonse to the question: Absent any CMS requirements to do so, indicate your best estimate for how many years it would be before your ACO would be willing to share losses, all survey responses.

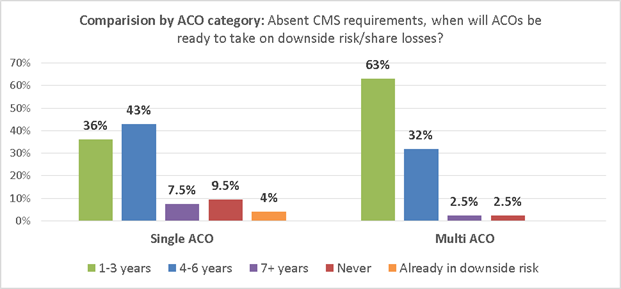

Looking at responses from single and multi-ACOs in figure 8, the readiness to take on downside risk varies. Multi-ACOs responded with 95 percent indicating they are ready to take on downside risk within six years and 63 percent ready within three years. On the other hand, single ACOs responded with 79 percent ready to take on risk within six years and 36 percent of those ready within three years.

Figure 8: Survey repsonse to the question: Absent any CMS requirements to do so, indicate your best estimate for how many years it would be before your ACO would be willing to share losses, comparing single and multi ACO survey respondents.

Survey Findings: ACOs and MACRA

“We continue to invest significant resources and were very disappointed in CMS’s recent decision not to allow Track 1 ACOs for the 5 percent APM bonus.” ~Survey respondent

MACRA is one of the most important policy changes in recent history. A significant MACRA proposed rule was released by CMS on April 27, 2016, and it points to some important changes that will have rippling, long term effects on health care and ACOs in particular.

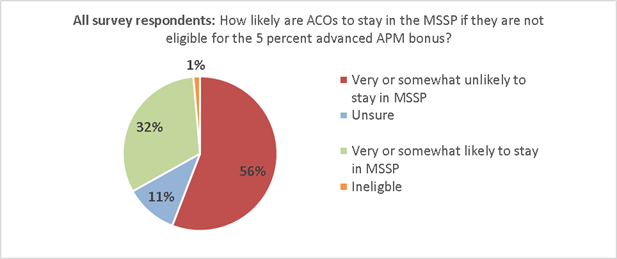

To learn how ACOs may respond to MACRA, the participants were asked how likely their ACO would stay in the MSSP if they were not eligible for the 5 percent Advanced APM bonus. In fact, over half of the respondents indicated that they would leave the program. As seen in figure 9 on the following page, 56 percent selected very or somewhat unlikely to stay in the MSSP, 11 percent are unsure, 32 percent said very or somewhat likely they would stay, and two percent were ineligible (to stay in Track 1 beyond the current agreement).

Figure 9: Survey repsonse to the question: How likely is it that your ACO would stay in the MSSP if Track 1 ACOs were not eligible for the APM 5 percent bonus, all survey responses.

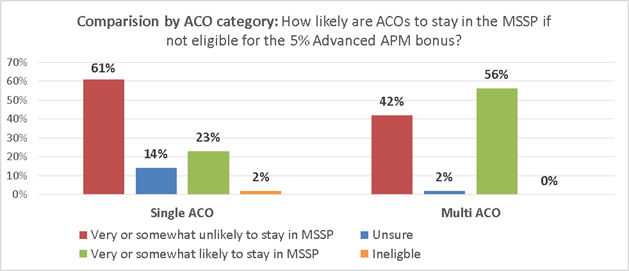

Of those who indicated that they would likely leave or stay in the MSSP in figure 9 above, interestingly the single ACOs are more likely to leave the MSSP and the multi-ACOs are more likely to stay. In figure 10 below, over half (61 percent) of the single ACOs are very or somewhat unlikely to stay in MSSP, 14 percent are unsure, 23 percent are very or somewhat likely to stay in MSSP, and two percent are ineligible to remain in Track 1 beyond their current agreement period, based on current CMS policy. Of the multi-ACOs, 42 percent are very or somewhat unlikely to stay in MSSP, two percent are unsure, and over half (56 percent) are very or somewhat likely to stay in MSSP. Similar to figure 6 on page 10, the finding points to a potential that of those who may leave the MSSP, the single ACOs may be the first to exit the program.

Figure 10: Survey repsonse to the question: How likely is it that your ACO would stay in the MSSP if Track 1 ACOs were not eligible for the APM 5 percent bonus, comparing single and multi-ACO survey respondents.

Conclusion

In summary, the key findings from the NAACOS Cost and MACRA Survey include:

- How much are ACOs investing?

- Just over half (51 percent) of the ACOs describe their ongoing operational costs as very significant and only six percent describe it as nominal (five percent) or negligible (one percent).

- The average total operating costs for all respondents is $1.6 million per year, but the difference is significant between single or multi-ACOs, with single ACOs averaging just under $2 million and multi-ACOs averaging almost $1 million per year.

- How much and how quickly are ACOs able to take on downside risk?

- If required by CMS to take on downside risk, 43 percent said they would leave the program and about a third would stay (33 percent).

- Over three quarters of the ACO respondents (84 percent) said they would be ready for downside risk within the next six years, with 44 percent of those even ready as soon as 1-3 years.

- How do ACOs feel about Track 1 being excluded from the list of proposed Advanced APMs under MACRA?

- Over half (56 percent) of the respondents indicated that they would leave the program and about a third would stay (32 percent).

- The findings from single and multi-ACO comparisons indicate that that multi-ACOs are more likely to stay in the MSSP, even if required to take on downside risk. If Track 1 ACOs are excluded by CMS from being considered eligible APMs under MACRA, single ACOs are more likely to leave the program than multi-ACOs.

NAACOS hopes that these findings will spark conversations about the investment, risk, and policy challenges facing ACOs and healthcare systems in today’s rapidly evolving environment. As the survey findings demonstrate, ACOs are investing a significant amount and are maturing in their readiness to take on downside risk, surprisingly fast considering how few years the program has been in place. Over the last few years, many of the ACOs in the survey have been part of “…the most positive delivery system improvements in our nation’s history…,” as referenced on page 3. ACOs are effective in aligning value and quality initiatives to provide supportive, non-duplicative care for their patients.

ACOs just need supportive policies.

To learn more about NAACOS’s policy recommendations and advocacy efforts, please see the NAACOS advocacy webpage.

Appendix: NAACOS ACO Cost and MACRA Survey Questions

|

NAACOS ACO COST AND MACRA SURVEY QUESTIONS |

|

|

QUESTION 1: In what year did your Track 1, 2 or 3 ACO begin participating in the Medicare Shared Savings Program (MSSP)? |

|

|

Those with a start year between 2012-2015 answered the following questions: |

Those who started in 2016 answered similar but a different set of questions: |

|

QUESTION 2: Absent any CMS requirements to do so, please indicate your best estimate for how many years it would be before your ACO would be willing to share losses, i.e. downside risk, for patient expenditures under Medicare. Downside risk means the ACO would be responsible for paying CMS for a portion of ACO beneficiary expenditures if the expenditures exceed the benchmark and the minimum loss rate. |

SAME

|

|

QUESTION 3: How likely is your ACO to participate in the MSSP if CMS requires ACOs to share losses, i.e. downside risk, for patient expenditures? Downside risk means the ACO would be responsible for paying CMS for a portion of ACO beneficiary expenditures if the expenditures exceed the benchmark and the minimum loss rate. |

SAME

|

|

QUESTION 4: Beginning in 2019, the Medicare Access and CHIP Reauthorization Act (MACRA) provides for a 5% annual bonus for physicians participating in Medicare eligible alternative payment models (APMs). To date, Congress and CMS have not decided whether Track 1 ACOs would qualify to earn the MACRA bonus, and early indications from CMS reveal the agency is leaning towards deeming Track 1 ACOs ineligible for MACRA physician bonuses. How likely is it that your ACO would stay in the Medicare Shared Savings Program if Track 1 ACOs were not eligible for the APM 5% bonus? |

SAME

|

|

QUESTION 5: Which of the following words or phrases best describe your perspective regarding the investments your ACO has made (including both start-up costs and ongoing operating costs) to participate in the MSSP? |

SAME

|

|

QUESTION 6: Please indicate the average number of beneficiaries assigned to your Medicare ACO for 2015. This number can be found as the assigned beneficiary person-years on your ACO’s 2015 Quarter 4 Aggregate Expenditure/Utilization Trend Report from CMS. |

SAME other than: “This number can be found in your quarterly report package from CMS. It will be named: P.AXXXX.ACO.AASR.D######.T#######”

|

|

QUESTION 7: Please indicate the number of existing shared risk/savings agreements, and the approximate number of members in those agreements that your ACO has with payers other than Medicare. Members under these agreements may be Medicaid beneficiaries, Medicare Advantage enrollees, or commercial members insured by private payers or self-funded groups. Current Shared Risk/Savings Agreements with Payers Other than Medicare: |

SAME

|

|

QUESTION 8: Please indicate the number of new shared risk/savings agreements with payers other than Medicare that your ACO is actively considering or negotiating, and provide the expected number of members associated with these agreements. Members under these agreements may be Medicaid beneficiaries, Medicare Advantage enrollees, or commercial members insured by private payers or self-funded groups. Shared Risk/Savings Agreements with Payers Other than Medicare Under Active Consideration or Negotiation Currently: |

SAME

|

|

QUESTION 9: In the table below, please provide estimated 2015 operating costs by category for your Medicare ACO. Please note the following as you respond:

(i) Clinical and care management (ii) Healthcare information technology, population analytics, and reporting (iii) ACO management, administration, financial, legal, and compliance (iv) Other (sum of all other operating costs) For each category, the costs should include compensation and benefits for employees as well as consulting, vendor, and other fees for purchased services. |

SAME other than: “…estimated 2016 budgeted operating costs…”

|

|

QUESTION 10: Please provide any additional feedback related to your ACO’s operating costs and/or your perspective on MACRA implementation. |

SAME

|

|

QUESTION 11: Full Legal Name of ACO |

|

|

QUESTION 12: Name of Person Completing Survey |

|

|

QUESTION 13: Email Address of Person Completing Survey |

|

Suggested Citation: National Association of ACOs. (2016). NAACOS ACO Cost and MACRA Implementation Survey. Available from www.naacos.com