Medicare’s Incentives Favor the Status Quo Over Accountable Care

August 31, 2023

Highlights:

- Incentives under the Medicare Access and CHIP Reauthorization Act (MACRA) now favor the Merit-Based Incentive Payment System (MIPS).

- Congress must revisit MACRA’s incentive payment structure if lawmakers want to continue seeing growth in value-based payment arrangements.

- The Value in Health Care Act (H.R. 5013) provides a multi-year commitment to reforming care delivery by extending MACRA’s original 5 percent advanced APM incentive payments for two years to continue to encourage the movement to value.

By: Robert Daley, Director, Legislative Affairs, National Association of ACOs, and Jennifer Gasperini, Director, Regulatory and Quality Affairs, National Association of ACOs

Over the last two decades, alternative payment models (APMs) have demonstrated that when providers are accountable for costs and quality and provided flexibility from fee-for-service (FFS) constraints, they are able to generate savings for taxpayers and improve beneficiary care. In 2022, accountable care organizations (ACOs) generated $4.3 billion in gross savings of which $1.8 billion was returned to Medicare. ACOs have generated $21 billion in gross savings over the last decade. APMs create the structure and incentives for providing person-centered coordinated care, rewarding quality over volume.

A key step on this journey to value and accountable care was when Congress passed MACRA in 2015. The primary goal of this legislation was to shift how Medicare pays for health care services to encourage keeping patients healthy, reducing unnecessary care, and lowering costs for both patients and taxpayers. Accordingly, the law eliminated Medicare’s sustainable growth rate (SGR) formula, established unified quality reporting systems, and provided financial incentives for clinicians to join APMs.

The MACRA 5 percent incentive payment for clinicians in advanced APMs (i.e., risk bearing APMs) recognized that FFS payment alone is not sufficient to build infrastructure and engage in care delivery redesign needed to be successful in advanced APMs. The incentive payments have allowed clinicians to expand care teams, develop programs to improve beneficiary care, and adopt population health infrastructure. This has proved successful as participation in advanced APMs has grown by more than 173 percent following implementation of MACRA.

Anticipating a future state with broad adoption of APMs, Congress planned for an end to incentive payments and continuing to incentivize providers by instead providing a higher conversion factor update for clinicians in advanced APMs. While growth in APMs has been promising, we have not made as much progress as we once hoped. Congress must continue to encourage participation in ACOs and other value-based care models by ensuring incentives favor accountable care.

MACRA’s incentives now favor MIPS and fee-for-service.

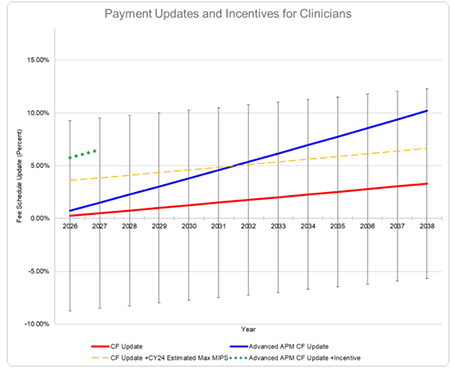

Beginning in Payment Year 2026 (Performance Year 2024), incentives will favor clinicians who are not participating in advanced APMs and remain in MIPS. The chart below models the potential incentives. In 2026, clinicians in MIPS will be provided a 0.25 percent conversion factor update (red line) and can receive an additional positive payment adjustment in MIPS. While maximum potential incentives under MIPS are 9 percent, the average MIPS adjustment is around 3 percent. Accordingly, the total potential payment adjustment is an estimated 3.25 percent (yellow dashed line). Conversely, clinicians in advanced APMs will only receive a 0.75 percent conversion factor update (blue line). Modeling these changes out several years, 2032 will be the first year in which incentives again favor clinicians in advanced APMs.

The red line indicates the annual conversion factor (CF) payment updates for clinicians that participate in MIPS. The dashed yellow line represents annual CF update for clinicians in MIPS plus the average MIPS payment adjustment. In the CY 2024 MPFS proposed rule, CMS indicated that the average positive payment adjustment is 3.35 percent for the 2024 performance period/2026 MIPS payment year. This chart assumes the 3.35 percent MIPS payment adjustment remains unchanged; however, the average payment adjustment has typically increased each year. The error bars indicate the annual CF update with maximum and minimum potential MIPS payment adjustments. The blue line indicates the annual CF update for clinicians in advanced APMs. This assumes that the clinician qualifies for the higher conversion factor each year. The dashed green line represents the annual CF update for clinicians in advanced APMs and a two-year extension of the advanced APM incentives.

Extending the advanced APM incentive payments would right-size the incentives and is a good investment.

Continuing a 5 percent advanced APM incentive payment for clinicians (green dashed line in the chart above) would ensure that there are stronger incentives for clinicians in advanced APMs. Lawmakers should support the bipartisan Value in Health Care Act (H.R. 5013), which includes a two-year extension of MACRA’s original 5 percent advanced APM incentives and adjusts the one-size-fits-all approach to qualification thresholds to ensure that providers will continue to participate in APMs.

While Congress passed a one-year, 3.5 percent extension of the incentives last year, the increase in average MIPS adjustments illustrates that stronger incentives are needed to continue encouraging growth in risk-based payment models that account for cost and quality of patient care.

Additionally, Medicare’s advanced APM incentives are a good return on investment as the $1.8 billion returned to Medicare by ACOs in 2022 far exceeds the estimated $644 million paid in incentives this year. These incentives have been critical in helping clinicians cover the investment costs of moving to new payment models that improve care for their patients and expand services beyond traditional Medicare.

Congress needs long-term solutions for incenting accountable care.

Going forward, Congress must ensure that clinicians receive adequate payment updates with any additional incentives reserved for clinicians who move to APMs. Incentives are the building blocks to care transformation and lawmakers should consider the following:

- Decouple advanced APMs from the MIPS program and structure MIPS to incentivize participation in APMs.

- Simplify the incentive structure and account for providers serving rural and underserved populations.

- Redesign physician payment incentives to promote value by developing a three-tier system that provides increased flexibility and financial incentives for the adoption of value. The participation tracks should be:

- Fee-for-service (MIPS)—Clinicians that are not participating in any APM. MIPS should be revised so that the program does not incentivize remaining in MIPS. Specifically, Congress should structure MIPS to have adequate payment adjustments for physicians but no additional incentives unless clinicians are taking steps to move to more accountable payment models.

- APMs—Clinicians participating in ACOs or other APMs that hold them accountable for cost and quality. Clinicians in this track should be exempt from MIPS quality reporting and only held to the quality and payment parameters of their model. Financial incentives should recognize the up front and ongoing investments needed to be successful in APMs.

- Advanced APMs—Clinicians participating in risk-based models. This track should have the strongest financial incentives and flexibility.