June 27, 2016

Mr. Andrew Slavitt Acting Administrator

Centers for Medicare & Medicaid Services

U.S. Department of Health and Human Services

Hubert H. Humphrey Building

200 Independence Avenue, S.W.

Washington, DC 20201

Re: (CMS-5517-P) Medicare Program; Merit-Based Incentive Payment System (MIPS) and Alternative Payment Model (APM) Incentive Under the Physician Fee Schedule, and Criteria for Physician-Focused Payment Models

Submitted on June 27, 2016 via www.regulations.gov

Dear Acting Administrator Slavitt:

The National Association of ACOs (NAACOS) appreciates the opportunity to submit comments on the proposed rule, “Medicare Program; Merit-Based Incentive Payment System (MIPS) and Alternative Payment Model (APM) Incentive Under the Physician Fee Schedule, and Criteria for Physician-Focused Payment Models” (file code CMS-5517-P), as published in the May 9, 2016 Federal Register. We supported passage of the Medicare Access and CHIP Reauthorization Act (MACRA) and appreciate the opportunity to comment on a number of important proposals outlined in this MACRA Notice of Proposed Rulemaking (NPRM).

NAACOS is the largest association of Medicare ACOs, representing over 3 million beneficiary lives through 180 Medicare Shared Savings Program (MSSP) ACOs, Next Generation, and Pioneer ACOs. NAACOS is an ACO member-led and member-owned non-profit organization that works on behalf of ACOs across the nation to improve the quality of Medicare delivery, population health and outcomes, and health care cost efficiency. Our members, more than many other healthcare organizations, want to see an effective, coordinated patient-centric care process. Our recommendations reflect our expectation and desire to see ACOs achieve the long-term sustainability necessary to enhance care coordination for Medicare beneficiaries, reduce healthcare costs, and improve quality in the Medicare program.

ACOs represent a refined approach to the delivery of health care and were created through a bipartisan effort to facilitate coordination and cooperation among providers to improve the quality of care and to reduce unnecessary costs. Although the ACO model holds great promise, Medicare ACOs are at a crossroads. After initial rapid growth in the MSSP and strong commitments from ACOs to a model that can transform care delivery, recent proposals such as the MACRA NPRM and policy decisions by the Centers for Medicare & Medicaid Services (CMS) and the Administration could significantly undercut the ability of ACOs to flourish individually and collectively. Should the Administration remain on its current policy trajectory, Medicare ACOs may be destined to decline over time, precipitating the end of today’s ACOs.

Implementation of MACRA will be a central determinant in the future of Medicare ACOs, and CMS proposes many key details in the NPRM that will significantly affect ACOs.

To address these concerns and keep ACOs viable, this letter urges CMS to make a number of changes in the final rule, such as: including Track 1 MSSP ACOs in the list of Advanced Alternative Payment Models (APMs), accounting for ACO investments towards determining risk, adding a new MSSP track with appropriate amounts of risk, and ensuring as few burdens as possible for ACOs that must report under the Merit-based Incentive Payment System (MIPS).

Summary of Key Recommendations

As detailed in this letter, NAACOS recommends a number of changes to CMS’s MACRA NPRM, including requests that the agency:

Specific Proposals and NAACOS Feedback

Alternative Payment Models

“Advanced” Rather than “Eligible” APMs

Key recommendation:

MACRA requires an eligible APM meet three criteria: (1) APM participants must use certified Electronic Health Record (EHR) technology; (2) the APM must pay providers, in part, based on quality measures comparable to those in the quality performance category under MIPS; and (3) the APM entity either bears risk for losses greater than a specified nominal amount or is part of a Medical Home Model expanded by CMS under their authority from the Social Security Act.

On page 28169, CMS outlines their principles that formed the basis for the Advanced APM policies in the NPRM stating, “our goals…are to expand the opportunities for participation in APMs, maximize participation in current and future Advanced APMs, create clear and attainable standards for incentives, promote the continued flexibility in the design of APMs, and support multi-payer initiatives across the health care market.” CMS then explains that the MACRA APM bonuses would only be available to “Advanced APMs” participating in models that are designed to be challenging and involve rigorous care improvement activities. The introduction of the term “Advanced APM,” which CMS uses in place of “eligible APM,” as referred to in the MACRA statute, is notable. CMS raises the bar considerably with its definition of an Advanced APM, going much further than required by statute.

CMS has also publicly stated its intent to pay MACRA APM bonuses only to those in the most highly advanced APMs. Finalizing this approach contradicts their comments on maximizing participation in APMs and would mean only a small percentage of APM participants would receive MACRA APM bonus payments. This represents a serious misrepresentation of the MACRA statute and the intent of Congress. MACRA provides two pathways for physicians to choose: MIPS or APMs. It does not require participation in “Advanced” APMs, nor does it restrict incentive payment to physicians in the most highly advanced APMs. CMS’s proposed criteria for what qualifies as an Advanced APM is so stringent that, if finalized, only six APMs would be considered Advanced APMs eligible to earn the 5 percent APM bonus. We urge CMS to use a broader and more inclusive approach to defining eligible APMs that would qualify for the MACRA bonus.

Advanced APM List

Key recommendations:

The initial Advanced APM list includes six models: (1) Comprehensive End Stage Renal Disease (ESRD) Care (large dialysis organization arrangement), (2) Comprehensive Primary Care Plus (CPC+), (3) MSSP Track 2,

(4) MSSP Track 3, (5) Next Generation ACO Model, and the (6) Oncology Care Model, two-sided risk

arrangement. Unfortunately, Track 1 of the MSSP is notably absent from this list. Based on the many reasons detailed in this letter, we strongly urge CMS to add MSSP Track 1 ACOs to the final list of Advanced APMs.

We are extremely pleased that Track 2 and 3 of the MSSP and the Next Generation ACO Model are on the proposed list of Advanced APMs. These ACOs represent the forefront of organizations dedicated to enhancing the experience of care, improving the health of populations, and reducing per capita costs of health care. We are proud to include many of these ACOs as our members and look forward to working with CMS to refine and advance these ACO models moving forward to ensure their long-term success. We strongly support including MSSP Tracks 2 and 3 and the Next Generation ACO model as Advanced APMs and urge CMS to include them on the final Advanced APM list.

CMS includes CPC+ as an Advanced APM, which is the only one to qualify based on being an expanded Medical Home Model. We are very pleased that CMS recently reversed its initial decision to exclude MSSP ACO primary care practices from participating in CPC+. However, in the agency’s revised CPC+ FAQs, CMS notes that MSSP Track 1 practices selected for CPC+ would not be eligible for the Advanced APM bonus based on their MSSP participation. This makes little sense as these providers would be participating in two of CMS’s premier APMs, one of which is included on the Advanced APM list. The unintended consequence of withholding the APM bonus from these practices would be to incentivize them to leave their ACO to participate in CPC+ and earn the APM bonus. By putting primary care practices in this either/or position, CMS will slow the adoption of accountability for total cost of care, the greatest opportunity to bend the cost curve. We urge CMS to allow ACO primary care practices selected for CPC+ to be eligible for the Advanced APM bonus.

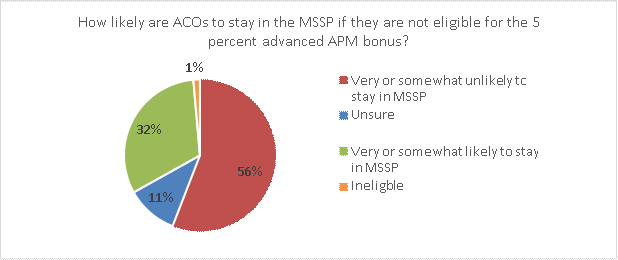

To better understand how ACOs may respond to MACRA and CMS’s implementation approach, NAACOS recently conducted a survey of MSSP ACOs on their costs, ability to take on risk, and feedback on MACRA implementation. The survey included 2016 MSSP ACOs, including those with MSSP start dates ranging from 2012 to 2016. A total of 144 unique ACOs out of 433 in the MSSP responded, and these respondents included a variety of ACOs based on size, MSSP start year, ACO structure, and geographic representation across 40 states, reflecting the broad range of MSSP ACOs. Our survey asked how likely ACOs would be to stay in the MSSP if they are not eligible for the 5 percent Advanced APM bonus. As illustrated in Figure 1 below, 56 percent of the ACOs responded that they would leave the MSSP.

Figure 1: Survey repsonse to the question, “How likely is it that your ACO would stay in the MSSP if Track 1 ACOs were not eligible for the APM 5 percent bonus?”

To ensure the long-term sustainability of the Medicare ACO model, we urge CMS to include Track 1 MSSP ACOs as Advanced APMs in the agency’s final MACRA regulation. Not doing so significantly undermines the efforts of these ACOs, which have been at the forefront of committing to alternative payment models and improving beneficiary care and health outcomes through better care coordination and quality.

Financial and Nominal Risk Criteria for Advanced APMs (other than Medical Home Models)

Key recommendations:

CMS proposes two main components to Advanced APM financial risk: (1) what it means for an APM Entity to bear financial risk for monetary losses under an APM; and (2) what levels of risk CMS proposes to be in excess of a “nominal amount” as required in MACRA. To qualify as “Advanced,” an APM must meet both the financial risk standard and nominal risk standard or be a Medical Home Model expanded under section 1115A of the Social Security Act. The agency proposes that an Advanced APM meet a “generally applicable financial risk standard” such that if an Advanced APM’s actual expenditures for which the APM Entity is responsible exceed expected expenditures during a specified performance period, CMS would:

CMS proposes that financial risk for monetary loss under an APM must be tied to performance under the model, as opposed to indirect losses related to financial investments made by APM Entities. For example, in the NPRM, the agency states:

“Many stakeholders commented that business risk should be sufficient to meet this financial risk criterion to be an Advanced APM. We also considered whether the substantial time and money commitments required by participation in certain APMs would be sufficient to meet this financial risk criterion. However, we believe that financial risk for monetary losses under an APM must be tied to performance under the model as opposed to indirect losses related to financial investments APM Entities may make. The amount of financial investment made by APM Entities may vary widely and may also be difficult to quantify, resulting in uncertainty regarding whether an APM Entity had exceeded the nominal amount required by statute.” (p. 28304).

Before defining financial risk, the purpose of financial risk must be established. As most APMs are voluntary, CMS should recognize that organizations will not continue to participate over multiple years of losses. Medicare benefits from APMs primarily from sharing in positive value created by health care providers and should reward providers for their investments in pursuing these models. We are very disappointed that CMS proposes to disregard the significant financial investments ACOs make in start-up and ongoing costs by not including these costs as part of the definition and calculation of risk.

MACRA requires that an eligible APM entity “bears financial risk for monetary losses under such alternative payment model that are in excess of a nominal amount.” However, the statute does not specifically exclude investment costs from counting towards the definition of financial risk for monetary losses. Further, we do not believe Congress intended to have CMS prohibit investments from counting towards criteria for meeting risk, and the legislative language does not support CMS’s interpretation of financial risk. Congress would have built the concept of two-sided risk into the eligible APM Entity definition had that been its intent, but Congress did not do so. It recognized the principle from the ACO authorizing statute that one of the purposes of providing for the creation of ACOs is to “encourage investment in infrastructure and redesigned care processes for high quality and efficient service delivery.”

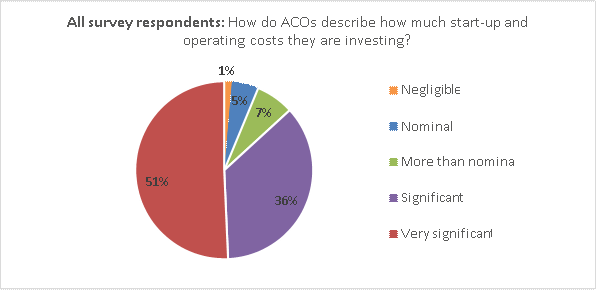

That investment—the cost of switching to a fundamentally different approach to patient care—is in and of itself a substantial risk. ACOs incur these costs with the goal of earning shared savings payments, but less than 30 percent of ACOs have earned shared savings in recent years. Therefore, ACOs must consider and account for their investment costs as risk inherent in MSSP participation. These investments include start- up and operating costs to help fund critical ACO activities designed to improve beneficiary care, enhance care coordination, and reduce unnecessary spending and hospitalizations. We urge the agency to recognize these investment costs and consider them as risk, thus allowing Track 1 ACOs to qualify as Advanced APMs. When asked to describe their investments, over half (51 percent) of the ACO respondents to our survey said that their ACO’s investment is “very significant,” as seen in Figure 2.

Figure 2: Survey response to the question, “Which word or phrase best describes your perspective regarding the investments your ACO has made (including both start-up and ongoing operating costs) to participate in the MSSP?”

Our survey also included more detailed questions about these costs, breaking them down into four categories detailed in Table 1 below.

Table 1: Survey responses to the question, “Provide estimated marginal operating costs attributable to your participation in the MSSP.”

| Estimated ACO Operating Costs: | Total Averages: |

| Clinical and care management | $642,044 |

| Health care information technology, population analytics, and reporting | $501,300 |

| ACO management, administration, financial, legal, and compliance | $402,272 |

| Other (sum of all other operating costs) | $121,115 |

| Total operational costs: | $1,622,032 |

As these results demonstrate, the costs of redesigning care delivery to improve beneficiary health are significant. These investments are essential to improve care, and ACOs spend this money on initiatives such as:

Based on our survey response rate of 33 percent, we feel confident in the average estimate of $1.6 million in annual operating costs. We understand the variability of these investments, which can be influenced by characteristics such as ACO size, structure, experience with population health payment models, or funding available to the ACO. However, this amount also aligns with CMS’s own previous estimates. In the November 2011 Final ACO Rule, CMS stated:

“In order to participate in the program, we realize that there will be costs borne in building the organizational, financial and legal infrastructure that is required of an ACO as well as performing the tasks required (as discussed throughout the Preamble) of an eligible ACO, such as: quality reporting, conducting patient surveys, and investment in infrastructure for effective care coordination.” (Final ACO Rule, 76 Fed. Reg. 212, November 2, 2011).

“Our cost estimates for purposes of this final rule reflect an average estimate of $0.58 million for the start-up investment costs and $1.27 million in ongoing annual operating costs for an ACO participant in the Shared Savings Program” (Final ACO Rule, 76 Fed. Reg. 212, November 2, 2011).

CMS based these estimates in part on those related to the Physician Group Practice (PGP) Demonstration, a precursor to the MSSP that ran from 2005 to 2010. In the November 2011 Final ACO Rule, CMS explained:

“An analysis produced by the Government Accountability Office (GAO) of first year total operating expenditures for participants of the Medicare PGP Demonstration varied greatly from $436,386 to $2,922,820 with the average for a physician group at $1,265,897 (Medicare Physician Payment: Care Coordination Programs Used in Demonstration Show Promise, but Wider Use of Payment Approach May Be Limited. GAO, February 2008)”. (Final ACO Rule, 76 Fed. Reg. 212, November 2, 2011) “We continue to believe that the structure, maturity, and thus associated costs represented by those participants in the Medicare PGP Demonstration are most likely to represent the majority of anticipated ACOs participating in the Shared Savings Program.” (Final ACO Rule, 76 Fed. Reg. 212, November 2, 2011)

When adjusting for inflation using the Department of Labor Consumer Price Index inflation calculator, the average estimate in the November 2011 Final ACO Rule for ACOs in the MSSP would be $1,350,867, and adjusting the GAO average estimate for PGP participants in the first year of that program, 2005, would result in $1,550,844. These estimates closely align with the results from our survey. With repeated estimates providing similar results, it is difficult to see how CMS cannot include them in their calculations of risk. It is also perplexing that CMS acknowledges these investments but refuses to try to find a method to

account for them in order to allow these investments to meet requirements for risk. For example, in the ACO Investment Model Request for Applications, CMMI states:

“ACOs need a sustainable business model as they transition to payment arrangements that reward outcomes rather than volume. Given the time lag between when ACOs begin making investments and when they can realistically expect to receive sufficient shared savings to recoup their investments, organizations with less access to capital may be less likely to enter or sustain participation in Medicare ACO initiatives.”

We urge CMS to consider the substantial investments ACOs make in order to participate, including those related to clinical and care management, health IT/population analytics/reporting, and ACO management and administration.

CMS has stated concerns about not being able to properly quantify and verify ACO costs in order to formally account for them and allow them to count towards meeting required risk standards. However, each ACO has a separate Board of Directors with operating budgets and financial statements that include detailed information on the ACO’s spending. Further, CMS has experience collecting financial information from ACOs, which the agency did as part of its Advance Payment and ACO Investment Models. As part of the application process and on an annual basis during participation in these models, CMS required applicants to complete CMS forms to provide the agency with necessary spending and detailed financial information. CMS could take a similar approach and create a form that ACOs would have the option to complete in order to have specific investments count towards meeting Advanced APM risk standards. We also recommend CMS require ACOs to attest to the information they provide, and the agency would conduct audits to ensure validity of the information. In sum, we strongly recommend CMS develop a process to account for ACO costs and investments to allow those to qualify as meeting standards for more than nominal risk.

Nominal Risk Thresholds Required for Advanced APMs

Key recommendation:

CMS’s proposal for what it means to “bear more than nominal financial risk” is one of the issues at the heart of what determines whether an APM qualifies as an Advanced APM. To meet the “more than nominal” risk criteria required to qualify as an Advanced APM that is not an expanded Medical Home Model, CMS proposes a minimum loss rate at or below 4 percent, marginal risk of at least 30 percent, and total risk of at least 4 percent of expected expenditures. CMS proposes an exception where the MLR amount could exceed 4 percent and still meet the nominal amount standard as long as other portions of the nominal risk standard are met. This would be permissible if: (1) the size of the attributed patient population is small; (2) relative magnitude of expenditures under the APM is small; and (3) if the difference between actual and expected expenditures is not statistically significant.

In contrast to these standards and as permitted by statute, CMS proposes different standards for Medical Home Models to qualify as Advanced APMs. CMS proposes that a Medical Home Model must meet general financial risk standards, including the three general financial risk standards for Advanced APMs listed in the previous section, plus a fourth option only available for Medical Home Models. This proposed additional option is based on losing the right to all or some of an otherwise guaranteed payment (e.g., case management fee) contingent on performance against financial or quality metrics. CMS proposes that Medical Home Models qualifying as Advanced APMs would need to be at risk to forgo or owe CMS certain percentages of their revenue each year: (1) 2.5 percent of the APM Entity’s total Part A and B revenue in 2017, (2) 3 percent in 2018, (3) 4 percent in 2019, and 5 percent in 2020 and beyond. CMS proposes that beginning in 2018, the financial standards specific to Medical Home Models would only apply to APM Entities with 50 or fewer clinicians.

While the proposed financial risk thresholds for Advanced APMs are more reasonable than those currently required under the existing two-sided Medicare ACO models, the thresholds are still far too onerous for ACOs, especially those without considerable financial backing. Although MACRA exempts a Medical Home Model expanded under section 1115A(c) from the need to meet financial risk criteria, the legislation does not require that CMS set a higher definition of nominal risk for other APMs that are not an expanded Medical Home Model. CMS’s proposal goes well beyond what Congress intended with their phrase “more than nominal financial risk.” On page 28305 CMS states, “In general, we believe that the meaning of “nominal” is, as plain language implies, minimal in magnitude. However, in the context of financial risk arrangements, we do not believe it to be a mere formality… Therefore, in arriving at the proposed values, we sought amounts that would be meaningful for the entity but not excessive.”

The proposed standards are not just slightly more than minimal; they are very high. In fact, as part of a dialog related to MIPS in the NPRM Regulatory Impact Analysis section, CMS discusses thresholds for “significant” risk, stating:

“On average, practitioners’ Medicare billings are only about 22 percent of total revenue, so even those practitioners adversely affected by MIPS would rarely face losses in excess of 3 percent of revenues, the HHS standard for determining whether an economic effect is “significant.” (In order to determine whether a rule meets the [Regulatory Flexibility Act] RFA threshold of “significant” impact HHS has for many years used as a standard adverse effects that exceed 3 percent of either revenues or costs.)” (p. 28365)

If, as CMS states, 3 percent of a practitioner’s revenue is the agency’s standard for “significant,” why is the agency proposing a loss sharing cap of 4 percent total cost of care to meet MACRA requirements for “more than nominal financial risk”? These thresholds are incredibly different and illustrate that the proposed four percent loss sharing cap is much too high.

Further, CMS’s proposed Medical Home Model thresholds pale in comparison to the onerous amounts of risk required of other Advanced APMs. Setting such a low bar for Medical Home Models will stall progress towards assuming accountability for total cost of care, which is the greatest opportunity to bend the cost curve in Medicare. CPC+ is the only Advanced APM proposed to qualify in 2017 under the Medical Home Model standard. CPC+ participants only face risk in the form of foregone payments of up to $24 per beneficiary per year (based on the $2.00 per month performance-based utilization payment in CPC+ Track 2). With such small amounts of foregone payments as risk, many physicians in CPC+ would be incentivized to focus on care delivery rather than controlling the total cost of care. This reinforces a fee-for-service mentality emphasizing volume rather than value, the latter of which is the core focus of population-based models and more closely aligns with CMS’s goals for transforming Medicare.

On page 28303, CMS states, “Medical Home Models differ from other APMs, such as ACO initiatives, because Medical Home Models focus on improving primary care through much more targeted and intensive interventions than those commonly found in other APMs. We hope to encourage participation in Medical Home Models for all organizations that can derive value from their designs, not just those that are too small to join ACO initiatives and other higher risk APMs.” We disagree. ACOs are at the forefront of efforts to improve primary care through targeted and intensive interventions. Further, many practices that consider participating in a Medical Home Model are often simultaneously considering joining or establishing an ACO. Therefore, setting such low standards for Medical Home Models to qualify as Advanced APMs while at the same time setting the bar so high for other APMs to qualify as Advanced would likely result in a deterioration of the latter to benefit the former. We recently saw an example of this when CMS announced that ACO primary care practices would be ineligible to participate in CPC+. That decision, which has since been reversed, caused many practices that were already part of ACOs to consider leaving the ACO to pursue CPC+. CMS may theoretically consider participants in Medical Home Models to be very different from participants in other Advanced APMs, but in reality these are often the same providers making decisions on which of these paths to take. We urge CMS to lower the proposed loss sharing limit for Advanced APMs from 4 percent to a more reasonable threshold, such as 1 percent of total Part A and B spending or 10 percent of physicians’ revenue for covered professional services under the Medicare Physician Fee Schedule.

Glide Path to Risk-Based Models

Key recommendation:

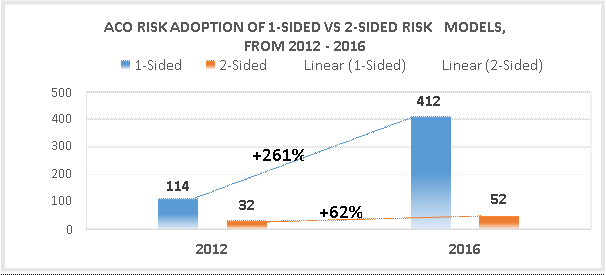

Since inception of the MSSP, CMS has emphasized the need for ACOs to assume downside financial risk for their patient populations. CMS argues that encouraging this “skin in the game” is the best way to incentivize ACOs to reduce unnecessary utilization and lower the growth rate of Medicare expenditures. As we have seen, it is a long, heavy lift for many ACOs to achieve early success, which is necessary to enable their continued participation and prepare them to migrate to two-sided models. The majority of ACOs are reluctant to participate in two-sided risk models largely due to the financial risk required and the considerable investments in their ACO.

To date, and as illustrated in Figure 3 below, the growth rate in two-sided risk models (MSSP Tracks 2 and 3, the Pioneer ACO Model, and Next Generation ACO Model) has been unimpressive, with four times as much growth in Track 1. As a portion of total 2016 Medicare ACOs, those in two-sided risk models only represent slightly more than 10 percent of total ACOs. As a result of losses and other program challenges, two-sided ACO programs have seen high dropout rates. The Pioneer Program is the best example of this, beginning in 2012 with 32 participants and only nine remaining participants in 2016. MSSP Track 2 ACOs also saw a 50 percent dropout rate between 2011 and 2015.

Figure 3: Adoption of Two-Sided ACO Risk Models

The limited uptake and early performance results of two-sided ACOs demonstrate that the economics of the current two-sided models are impractical. For many ACOs, the key determination is whether the ACO can commit to repaying CMS for losses incurred treating Medicare beneficiaries if the ACO’s actual costs exceed projections by more than a certain percent. The decision to take on risk is often at the heart of an ACO’s choice about which model to select. Despite CMS’s desire to attract ACOs to these models, that optimism cannot outweigh the realities ACOs face as they carefully consider the requirements for taking on two-sided risk. Having to potentially pay millions of dollars to Medicare is simply not practical nor feasible for these organizations. This type of risk often necessitates that ACOs have considerable financial backing, which is why, for the most part, these models have attracted ACOs with hospitals, health systems or outside investors.

While larger hospitals are likely to have greater assets and access to substantial lines of credit compared to smaller independent medical groups, they must be careful to properly evaluate the risks to the downside on both their bond ratings and their long-term financial viability. According to research conducted by the American Hospital Association, the average hospital operating margin has been trending between 5 and 7 percent in recent years. This contributes to a general reluctance to take on significant exposure to downside risk. Further, smaller or more rural hospitals and most independent medical groups are unable to access investor capital and face many barriers to obtaining sizeable credit. Without assets large enough to secure loans, many physician owners are left having to personally guarantee debts and obligations. Smaller, physician-led ACOs have been even more reluctant to add this level of risk to their balance sheet as they could not sustain the potential losses CMS requires them to protect against.

To understand the current risk models, we’ll use an example of a hypothetical ACO with 300 primary care physicians caring for 10,000 Medicare beneficiaries and a total benchmark of $100,000,000. On a national basis, all physician professional services comprise 19 percent of total Medicare Parts A and B spending.

However, that includes all specialty and hospital-based physicians, who are paid more than primary care physicians who typically comprise the majority of an ACO’s physicians. Most ACOs are organized and governed by a majority of primary care physicians so the physician spending is a smaller percentage of total patient cost. It is common for an ACO’s physicians, those assuming financial responsibility for the total cost of the ACO’s attributed beneficiaries, to have Medicare gross billings comprising about 10 percent of total costs. Therefore, in our example below, we assume gross Medicare income would be $10,000,000.

However, that gross income goes toward more than just physician salaries. In fact, according to the final 2015 Medicare Physician Fee Schedule, only about 50 percent of Medicare payment relates to physician work while 45 percent helps cover practice expenses such as building costs, equipment and staff salaries, and approximately 5 percent goes towards covering malpractice insurance. Therefore, that leaves the physicians an actual net income closer to $5,000,000, as seen in Table 2 below.

Table 2: Example of a hypothetical MSSP ACO

| Physicians | Beneficiaries | Cost per Beneficiary | Total Benchmark | Medical Group Gross Income | Physicians’ Income |

| 300 | 10,000 | $10,000 | $100,000,000 | $10,000,000 | $5,000,000 |

Under the first performance year of MSSP Track 2 (the lowest risk of any model for any year), an ACO is responsible for losses of up to 5 percent of its total benchmark, which increases to 10 percent by Performance Year three. Table 3 below illustrates how that translates into risk for the ACO owners.

Therefore, under the smallest amount of risk in a Medicare two-sided risk model, CMS requires ACO physicians to be liable for an amount equivalent to their entire Medicare net income.

Table 3: ACO Owner Risk

| Benchmark | Year 1 Loss Sharing Limit | Year 3 Loss Sharing Limit |

| $100,000,000 | $5,000,000 | $10,000,000 |

Basing risk on total cost of care creates situations where physicians could be responsible for repaying a substantial amount, if not all, of their Medicare income, and such high risk is not feasible for the vast majority of ACO physician owners. The challenges of taking on risk are often exacerbated in rural areas where ACOs tend to have even fewer resources and may struggle to come up with start-up and investment costs, let alone be in a position to assume downside risk. Even the promise of higher sharing rates or the ability to utilize waivers afforded to two-sided ACOs is not enough to overcome the barriers to assuming financial risk. Further, ACOs are in the business of delivering care and are not necessarily well equipped to take on what is essentially actuarial risk more typical of a health insurance company than a physician practice. Finally, while a slight majority of ACOs are physician owned, many others share ownership and financial responsibility with hospitals. The hospitals often have the same concerns about sharing in this level of risk. In summary, at this time the overwhelming evidence shows that the current Medicare two- sided ACO risk models are not viable for most ACOs and set the bar too high in terms of financial risk.

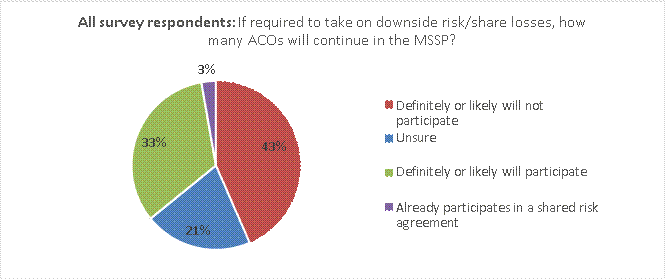

As seen in Figure 4, when asked how likely the ACO is to continue participating in the MSSP once CMS requires it to take on downside risk, less than half (43 percent) said they definitely or likely will not continue in the MSSP. Twenty-one percent were unsure, and a third will definitely or likely continue to participate.

Figure 4: Survey response to “How likely is your ACO to participate in the MSSP if CMS requires ACOs to share losses?”

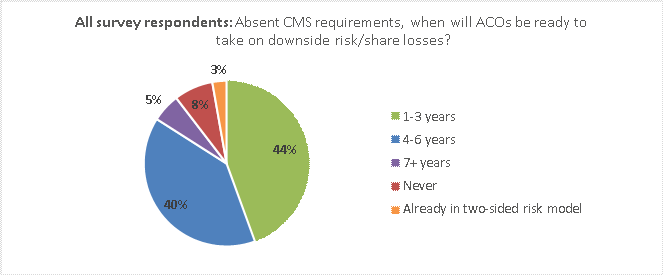

While many ACOs do not feel ready to take on risk now, most believe they will be prepared to do so in the future. When asked how many years until an ACO is willing to take on downside risk, 84 percent said within the next six years (44 percent within 1-3 years and 40 percent within 4-6 years), as seen in Figure 5 on the next page.

Figure 5: Survey response to “Absent any CMS requirements to do so, indicate your best estimate for how many years it would be before your ACO would be willing to share losses.”

It is promising that within six years, our data shows that a large majority of ACOs believe they will be ready to move to two-sided risk models. However, this question did not ask about the specific level of risk in two- sided ACO risk models, and many survey respondents also commented that they are very concerned about the amount of risk required in the current Medicare two-sided models. As one survey respondent commented, “We would like to see a pathway to risk sharing that allows us to build the necessary reserves.”

Proposed MSSP Track 1.5

Key recommendation:

ACOs are on the cusp of so much potential, and we strongly feel that creating a new track with more appropriate risk would benefit ACOs today and moving into the future. To address concerns with the current risk levels required under existing ACO models and those proposed for Advanced APMs in the NPRM, we urge CMS to implement a new MSSP track with more realistic levels of risk and include this on the Advanced APM list. This new model, MSSP Track 1.5, would incentivize ACOs to begin taking on risk in a manner that holds them accountable for cost and quality but does so in a more financially reasonable way, providing a glide path to assuming risk. The key elements of this proposed track are outlined below.

Financial Structure

Beneficiaries and risk adjustment

Quality and waivers

Allowing ACOs to Switch Tracks at the Start of Any Performance Year

Key recommendation:

An important consideration for ACOs hoping to qualify as Advanced APMs relates to the MSSP three-year agreement periods. Currently, ACOs may only switch MSSP tracks at the start of a new three-year agreement, and once that period begins they are locked into their decision until their next agreement. As ACOs consider their options for the future, it will be essential for CMS to adopt a more flexible policy to allow ACOs to move into two-sided risk models earlier than the start of their next agreement period. This is especially important given the current timeframes under CMS’s proposed MACRA implementation. ACOs entering into agreements for 2017 will likely not have final information from CMS on what qualifies as an Advanced APM until after they make their decision for 2017 ACO participation, which binds them to a particular track until 2020. Given that the 5 percent MACRA APM bonus is only in effect for a few years with the last performance year proposed for 2022, it would be incredibly unfair to lock ACOs into decisions they must make now when they do not have final CMS policies in place to guide them.

We recognize CMS’s goal to ultimately move ACOs to two-sided risk models; therefore, it is in the agency’s interest to find ways to accelerate this process for interested ACOs. Allowing ACOs to move to a risk-based model early would position the ACO to best balance their exposure to and tolerance for financial risk and would create a flexible glide path towards risk. We urge CMS to modify MSSP participation agreement rules to allow ACOs to voluntarily move into a two-sided risk model at the start of any performance year rather than having to wait until the start of their next agreement period.

QP Determinations

Key recommendations:

As specified by MACRA, CMS outlines the required proportion of payments that must be made “through” the APM Entity in order to qualify for the Advanced APM bonus. These payment thresholds are illustrated in Table 4 below, along with CMS’s proposed corresponding thresholds for a patient count approach. The agency proposes to calculate both thresholds for an APM Entity and utilize the one with the more favorable outcome for that APM Entity.

Table 4, Payment and Patient Count Threshold for Meeting QP Determination

| Payment Year | 2019 | 2020 | 2021 | 2022 | 2023 | 2024+ |

| QP Payment Threshold | 25% | 25% | 50% | 50% | 75% | 75% |

| Partial QP Payment Threshold | 20% | 20% | 40% | 40% | 50% | 50% |

| QP Patient Count Threshold | 20% | 20% | 35% | 35% | 50% | 50% |

| Partial QP Patient Count Threshold | 10% | 10% | 25% | 25% | 35% | 35% |

CMS proposes to calculate this threshold in the following manner: Attributed beneficiaries/Attribution- eligible beneficiaries.

The agency proposes that “attributed beneficiary” means a beneficiary attributed, according to the Advanced APM’s attribution rules, to the Advanced APM Entity on the latest available list of attributed beneficiaries during the QP Performance Period. For ACOs, this means CMS would use the latest available lists of attributed beneficiaries for MSSP ACOs and aligned beneficiaries for Next Generation ACOs. CMS proposes that attribution-eligible beneficiary means a beneficiary who meets a number of criteria during the QP performance period, including that he or she has a minimum of one claim for evaluation and management services furnished by an eligible clinician in the APM Entity group for any period during the QP Performance Period.

CMS would calculate the QP thresholds and make a QP determination across the APM Entity. If the Advanced APM Entity’s threshold score meets or exceeds the relevant QP threshold, then all eligible clinicians in that entity would receive the same QP determination for that year. Conversely, if the Advanced APM Entity’s threshold score is just below the QP threshold score, then all eligible clinicians in that group would be considered partial QPs and could decide whether to participate in MIPS. For eligible clinicians participating in multiple Advanced APMs, CMS proposes that if one or more of the eligible clinician’s Advanced APM Entities meets the QP threshold, then the clinician would be a QP. Conversely, if none of the Advanced APM Entities meet the QP threshold, but the eligible clinician meets the QP threshold on an individual level (i.e., by combining the activity from the two or more Advanced APMs), then the clinical would be a QP and thus eligible to earn the Advanced APM bonus.

Under CMS’s proposal, an ACO would be collectively evaluated rather than evaluated at the individual provider or participant TIN level (for ACOs with multiple TINs). We support evaluating ACOs at APM Entity level as this approach treats the ACO as a whole and reinforces the ACO model and avoids fractures within the ACO. We support CMS’s proposed approach to evaluating eligible clinicians participating in multiple Advanced APMs. We urge CMS to finalize its proposal to evaluate both payment and patient count thresholds and use the more favorable results for an APM Entity. This allows flexibility and will enable more APM Entities to qualify for the 5 percent Advanced APM bonus. We appreciate CMS’s proposed definitions and use of assigned and assignable beneficiaries as the numerator and denominator, as these definitions are consistent with those used in the MSSP. We urge CMS to finalize these proposals.

While we appreciate that the patient count thresholds are relatively lower than the payment thresholds required under MACRA, we are concerned that these thresholds are still too high. This would be especially true for ACOs that are referral centers, such as those with academic medical centers, which by the nature of their organization treat a higher proportion of non-assigned beneficiaries. Similarly, ACOs with a high proportion of specialists typically see more patients not attributed to the ACO. Setting the patient thresholds at the proposed levels would have the unintended consequence of preventing these types of ACOs from meeting the QP thresholds, especially in later years as the thresholds increase. Excluding these ACOs would essentially penalize them for fulfilling their missions and for treating the wide range of beneficiaries who are referred to them. We urge CMS to lower the proposed patient count thresholds.

Timing and Participation List for QP Calculation of APM Status

Key recommendations:

CMS proposes to define “participants” of an APM as eligible clinicians that are directly tied to beneficiary attribution, quality measurement, or cost measurement under the APM. The agency proposes that the Participation List for an APM Entity would be compiled from CMS-maintained lists identifying each eligible clinician by a unique TIN/NPI combination attached to the identifier of the Advanced APM Entity. In order for an eligible clinician to be part of the QP determination for the APM Entity and thus able to earn the Advanced APM bonus, CMS proposes to use the APM Entity’s Participation List as of December 31 of the performance year (i.e., December 31, 2017 List for 2019 APM status).

Under CMS’s proposed approach, the Advanced APM Entity would have to collectively meet the threshold values for participation in an Advanced APM during the corresponding QP Performance Period. CMS would make this assessment each year, independent of QP or Partial QP determinations made in previous years and accounting for Advanced APMs that begin or end on timeframes that do not align precisely with the QP Performance Period. CMS proposes to notify eligible clinicians of their QP or Partial QP status as soon as results are validated, and the agency anticipates that would occur in the summer following the performance year.

We recognize the rationale for using the Participation List for an APM on December 31 of the performance year in order to calculate the QP status for the corresponding payment year (i.e., December 31, 2017 Participation List for 2019 APM status). For the MSSP, individual providers/suppliers may be added or deleted during the performance year by notifying CMS within 30 days after the individual becomes, or ceases to be, a Medicare-enrolled provider/supplier that bills for items and services it furnishes to Medicare fee-for-service beneficiaries under a billing number assigned to the TIN of an ACO participant.

Given that MSSP Participation Lists may fluctuate throughout the year, it seems reasonable to use a December 31 list as it is the most recent list and closest to the payment adjustment year. For models that begin after the start of the calendar year, it makes sense for CMS to use the December 31 Participation List, which would allow models that begin later in the year to qualify for Advanced APM bonuses, provided the APM Entity meets the QP thresholds based on their December 31 Participation List.

Under the Next Generation Model, the specific date during the performance period of the Participation List has little impact as Next Generation Participation Lists do not fluctuate as do those in the MSSP. While we do not oppose the use of a December 31 Participation List, CMS must modify existing program requirements for the Next Generation Model to allow ACOs to make updates to their participation lists closer to the start of the performance period. Currently, there is approximately a six-month lag between when a Next Generation ACO must submit its participant list to CMS for a given performance year and the start of that performance year (i.e., an NGACO must submit its participant list for 2017 in mid-June 2016). Therefore, any NGACO provider added between mid-June 2016 and mid-June 2017 cannot participate until the 2018 Performance Year.

Given these long delays to add new participants and considering CMS’s proposal to use the December 31 Participation List, numerous providers who join a Next Generation ACO during the course of the year due to routine turnover would be ineligible from being considered QPs. For example, if a physician joins the NGACO July 1, 2016, he or she would be ineligible to receive an Advanced APM bonus until 2020. A three- and-a-half-year delay for a provider actively engaged in an APM is unreasonable and undermines participation in Advanced APMs. We urge CMS to modify Next Generation ACO policies to allow ACOs to submit supplemental participant list changes as close to or as late in the measurement year as possible to allow the maximum number of its participants to be considered for the QP evaluation.

We are incredibly concerned about the timing of when CMS would notify an APM of its QP determination. CMS states it expects this notification would likely occur during the summer following the close of the performance period. This means that an APM would not know if it met the QP threshold, and was thus exempt from MIPS for the prior year reporting, until well after the performance period ends. Therefore, to ensure they are not subject to a substantial cut in Part B reimbursement for failing to report under MIPS, all

clinicians who believe they are in the Advanced APM must still report for MIPS. This burdensome requirement is an unfunded mandate and appears to be an unintended consequence of CMS’s proposed timeline. CMS must calculate QP thresholds and notify APMs in a timeframe that allows them to report under MIPS, should they be required to do so. By not notifying APMs in a reasonable timeframe, it creates a scenario where providers in APMs are essentially penalized for their APM participation and would discourage APM participation in Medicare, the antithesis of what Congress intended with MACRA.

As the healthcare industry transitions from fee-for-service payments to value-based payment models, providers must make significant changes including how they interact with and treat patients, coordinate with other providers, and utilize health IT. They must also routinely evaluate feedback from patients and payers to adapt how they furnish care. ACOs are committed to making these types of changes and more. However, in order for the transition to value-based payment models to be successful, is it critical that payers, including Medicare, also make changes such as working more collaboratively with providers and providing timely and actionable data. The proposed timeframe for CMS’s notification of QP status seriously calls into question whether CMS is equipped to implement alternative payment models. We urge CMS to make QP determinations in a timely manner and notify APMs of their QP status by February 1 following the performance year. Further, any MIPS reporting deadlines should be no earlier than two months following the notification of QPM status. We urge CMS to finalize a notification policy focused on the APM Entity, which should receive the QP/APM determination rather than the TINs within the APM Entity.

Partial QP Election

Key recommendation:

CMS proposes to allow Partial QPs to choose whether to participate in MIPS and CMS would permit Advanced APM Entities to elect whether to participate in MIPS for a particular performance year. APM Entities would be able to change their election, but it would become permanent at the end of the performance year. While CMS formally proposes the Partial QP decision would be made across the APM Entity, the agency is also considering an alternative approach to allow Participant TINs within an ACO to make that determination at the TIN level. CMS seeks comment on the timing and process for Advanced APM Entities to elect whether to be subject to MIPS in the event of a Partial QP determination. We strongly support allowing Partial QPs to determine whether they want to be evaluated under MIPS and recommend that this decision be made at the APM Entity level, thus reinforcing the role of the APM as a collective body. Should CMS allow an ACO’s participant TINs to make different decisions related to their QP status, it would fracture the ACO and create confusion about the MIPS evaluation for the TINs and ACO itself.

Annual Release of Advanced APM list

Key recommendations:

CMS proposes to release final Advanced APM determinations by January 1, 2017, updated at least annually, and proposes to include Advanced APM determinations in the request for applications of any model announced after January 1, 2017. We recommend that the Advanced APM list be updated in a manner that allows clinicians to have the information necessary to make educated decisions about APM participation. The timeframe for 2017 performance and the release of a final rule, likely on or right before November 1, 2016, means ACOs will not know which ACO models will qualify as Advanced APMs for 2017 when they are making their participation decisions for the coming year. Moving forward, it is essential that CMS avoid putting providers in this unfair situation where they may be penalized as a result of a CMS change in Advanced APMs. Further, under current policy and addressed above in our comments, once in an MSSP track ACOs may not switch tracks until the start of their next three-year agreement period. Locking ACOs into a decision for three years, which they must make without complete information of what would qualify as an Advanced APM, is incredibly unfair. We urge CMS to allow ACOs to move to two-sided ACO risk models at the start of any performance year. For new APMs introduced by CMS, we support CMS’s proposal to include the Advanced APM determination in the request for applications.

Calculation and Payment of APM Bonus

Key recommendations:

The Advanced APM lump-sum bonus payment is equal to 5 percent of a QP’s Medicare covered professional services reimbursed according to the Physician Fee Schedule in the preceding year. As required by statute, the bonus would not be included in ACO benchmarks. CMS would only include supplemental service payments in the calculation of the APM Incentive Payment amount if they meet certain criteria.

CMS proposes to pay the Advanced APM bonus to QPs who are identified by their unique TIN/NPI combination as participants in an Advanced APM Entity on a CMS maintained list. The agency proposes that for eligible clinicians that are QPs, CMS would make the APM Incentive Payment to the TIN that is affiliated with the Advanced APM Entity through which the eligible clinician met the threshold during the QP performance period. This proposal means that for ACOs that have multiple participant TINs, the bonuses would be paid to the participant TINs rather than to the TIN of the ACO. Should an eligible clinician leave that TIN between the performance and payment year, CMS proposes to pay the Advanced APM bonus to the TIN listed on the eligible clinician’s CMS-588 EFT application form.

NAACOS recommends the Advanced APM bonus be paid to the APM Entity just as CMS pays the ACO for shared savings under the MSSP rather than directly paying the participant TINs within the ACO. This approach would allow ACOs to allocate incentive payments fairly and accurately in accordance with the shared risk for individual eligible clinicians in the APM Entity. The proposed approach for identifying supplemental payments to be included in the Advanced APM bonus calculation ignores the goals of

population-based payment models which strive to decrease traditional spending through care coordination and alternative approaches to providing care. Therefore, ACO providers work to lower their spending, which under CMS’s proposed Advanced APM bonus calculation, would penalize them by also lowering the amount of their bonus. We urge CMS to include ACO shared savings payments as supplemental service payments in the calculation of the APM incentive payment amount.

Use of Certified Electronic Health Record Technology (CEHRT)

Key recommendation:

As required by MACRA, APMs must utilize certified EHR technology. For Advanced APMs and Other Payer Advanced APMs, CMS proposes to adopt the same definition of CEHRT that is proposed for MIPS. CMS acknowledges that eligible clinicians will be expected to upgrade from technology certified to the 2014 Edition to technology certified to the 2015 Edition for use in 2018, and some eligible clinicians who have not yet adopted CEHRT may wish to delay acquiring CEHRT products until a 2015 Edition certified product is available.

For all APMs other than the MSSP, CMS proposes that an Advanced APM, including the Next Generation Model, must require at least 50 percent of eligible clinicians who are enrolled in Medicare (or each hospital if hospitals are the APM participants) to use the certified health IT functions outlined in the proposed definition of CEHRT to document and communicate clinical care with patients and other health care professionals. CMS proposes to increase this threshold to 75 percent by 2018 (i.e., the second QP performance period). For the purposes of the MSSP, CMS proposes that the certified EHR requirement would be met if ACOs are “accountable for their eligible clinicians’ use of CEHRT by applying a financial penalty or reward based on the degree of CEHRT use (such as the percentage of eligible clinicians that use CEHRT or the engagement in care coordination or other activities using CEHRT).”

NAACOS is very concerned that providers have been forced to transition to new EHRs to meet government criteria which is not beneficial for providers and causes significant disruptions. An EHR is a significant purchase which requires considerable financial resources as well as many staff hours to transition to a new or upgraded system and learn how to use it. Many vendors may not be ready to meet the new criteria, leaving providers out of luck with a potentially outdated system that would otherwise meet their needs. We urge CMS to allow the use of 2014 CEHRT at least through 2020, if not longer, depending on how many vendors are certified. Further, we strongly urge CMS not to finalize a threshold of 75 percent for 2018. This is far too high considering how heavily APMs must rely on their EHR vendor in order to be successful. We recommend CMS finalize a lower threshold for APM eligible clinicians’ use of certified EHR technology in 2018.

Additionally, CMS’s CEHRT proposal for the MSSP criteria lacks the specificity needed to provide meaningful feedback. The agency does not go into detail on how ACO providers would be held accountable for their use of CEHRT or how a penalty or reward would be levied based on the degree of CEHRT use. These details are essential and must be adequately spelled out in a proposed regulation, which is not done in this rule. We urge CMS to issue more details on their proposal related to MSSP CEHRT criteria and provide stakeholders an opportunity to comment.

Quality Measures Comparable to MIPS

Key recommendation:

Another criterion for an Advanced APM is providing payment for covered professional services based on quality measures comparable to those under the MIPS quality performance category. CMS proposes that for the Advanced APM measures to be comparable to MIPS measures, they should have an evidence-based focus and, as appropriate, target the same priorities (for example, clinical outcomes, use and overuse).

Since many of the quality measures used for the MSSP and Next Generation ACO model are also used in MIPS, these models have quality measures comparable to MIPS. We support CMS not requiring new measures to meet this requirement. However, as quality measures for the ACO models are considered, we feel it is important to note that the quality reporting requirements for the MSSP and Next Generation ACO model should be reconsidered and their overall burden reduced. Quality reporting under these programs is very onerous, and we urge CMS to reduce these quality reporting requirements through future rulemaking.

Other Payer APM

Key recommendation:

Beginning in 2021, which corresponds to a 2019 performance period, CMS will make determinations based on participation in both Medicare Advanced APMs and Other Payer Advanced APMs. The All-Payer Combination Option would not replace or supersede the Medicare Option but would allow eligible clinicians to become QPs by meeting a relatively lower threshold based on Medicare Part B covered professional services through Advanced APMs and an overall threshold based on services through both Advanced APMs and Other Payer Advanced APMs. CMS proposes that beginning with Payment Year 2021, the agency would conduct the QP determination sequentially so that the Medicare Option would be applied before the All-Payer Combination Option. The agency proposes to apply the All-Payer Combination Option only to an Advanced APM Entity group of eligible clinicians or eligible clinicians who do not meet either the QP Payment Amount or Patient Count Threshold under the Medicare Option but who do meet the lower Medicare threshold for the All-Payer Combination Option.

We appreciate MACRA’s recognition of providers engaging in APMs with payers other than Medicare and urge CMS to utilize a streamlined approach to collecting the information necessary for this participation to be counted towards meeting the QP thresholds. We recommend CMS minimize administrative burdens for providers to demonstrate their participation with these payers and look forward to submitting detailed comments when CMS proposes specifics for how providers would be evaluated and given credit for APM participation with payers other than Medicare.

Reporting APM Data on Physician Compare

Key recommendation:

The Social Security Act requires CMS to report publicly the names of eligible clinicians in Advanced APMs and, to the extent feasible, the names and performance of Advanced APMs. Currently, if an eligible professional or group submits quality data as part of an ACO, there is an indicator on the eligible professional’s or group’s profile page indicating this and all ACOs have a dedicated page on Physician Compare. CMS proposes to indicate on eligible clinician and group profile pages when the eligible clinician or group is participating in an APM and proposes to link eligible clinicians and groups to their APMs data, as relevant and possible, through Physician Compare.

There have been ongoing concerns about inaccurate information on the Physician Compare website, which is both difficult to correct and confusing for beneficiaries. Without accurate information and user-friendly capabilities, Physician Compare does not provide value to Medicare beneficiaries. If a provider identifies inaccurate information, it often takes months to correct on the website. Additionally, providers find it difficult to know whether a data point needs to be corrected in the Medicare Provider Enrollment Chain Ownership System (PECOS) or directly with Physician Compare. We urge CMS to clarify for each individual data item on Physician Compare whether it can be corrected via PECOS, or if it requires correction by a CMS contractor in charge of maintaining the Physician Compare website. There is also a considerable lag between information being updated in PECOS and subsequently reflected on Physician Compare. We urge CMS to ensure that updates made in PECOS are reflected on Physician Compare within 30 days.

Merit-Based Incentive Payment System (MIPS)

Section 101 of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) sunsets payment adjustments as they exist currently under the Physician Quality Reporting System (PQRS), Value-Based Payment Modifier (VBPM), and Electronic Health Record (EHR) Incentive Programs and replaces them with a Merit-Based Incentive Payment System (MIPS) under the Medicare Physician Fee Schedule. As detailed in our comments above, NAACOS believes all ACOs that meet QP thresholds should be considered Advanced Alternative Payment Models (APMs) and therefore should not be subject to MIPS requirements. We urge CMS to include Track 1 ACOs in the list of Advanced APM models. Should CMS not make such changes, the MIPS APM Scoring Standard could have huge implications for whether ACOs continue to participate in the MSSP and Next Generation ACO Models.

Congress’s clear intent for creating the MIPS program in MACRA was to harmonize and streamline the currently fragmented quality and performance improvement activities that exist in Medicare. We appreciate CMS’s current proposals to establish the MIPS program in a way that reduces administrative burdens on ACOs deemed “MIPS APMs” by allowing ACO quality reporting in the MSSP and Next Generation ACO Models to satisfy quality reporting requirements under MIPS and by providing other beneficial scoring adjustments in the MIPS APM Scoring Standard. However, NAACOS requests several changes to the agency’s proposals to further streamline reporting and analysis for ACOs who are already heavily invested and involved in each of the four areas of MIPS analysis. CMS must encourage MSSP and Next Generation ACOs to remain in these programs by creating a fallback option in MIPS for ACOs that do not meet Advanced APM or QP status, which reduces administrative burdens and allows for ACOs to continue to focus on their MSSP and Next Generation program goals.

MIPS Scoring Standard for APMs

NAACOS is pleased to see CMS recognizing ACOs’ efforts by creating a MIPS scoring standard for APMs that do not meet QP thresholds for Advanced APM status. It is crucial that CMS allows ACOs to continue to focus on their MSSP goals and leverage the work they have already done to improve quality, lower costs, and place a greater focus on population health and lowering the total cost of care. ACOs are true innovators and must be rewarded for the significant efforts and investments they have made to improve our health care delivery model. The following are our comments on the specific proposals for the MIPS APM Scoring Standard as they apply to ACOs.

Criteria for MIPS APMs and APM Identifiers

Key recommendations:

NAACOS supports CMS’s proposed criteria for identification of MIPS APMs as well as the proposal to create APM Entity Group identifiers, with four levels of identification: the APM identifier; the APM entity identifier; TIN; and EP/NPI. CMS proposes to apply all bonus/penalties at the unique TIN/NPI level with all eligible clinicians in the APM Entity receiving the same Composite Performance Score (CPS) under the MIPS APM Scoring Standard. NAACOS supports providing ACOs with one ACO Entity level score. This approach aligns with ACO program goals to focus collectively on care transformation activities as an ACO Entity. We urge CMS to use this approach consistently for all of the MIPS APM Scoring Standard elements, as described in more detail in our comments below.

We are supportive of CMS’s proposal to use MSSP criteria for determining the list of eligible clinicians participating under the ACO for the purposes of establishing the list of MIPS eligible clinicians included in the APM Entity for purposes of the APM Scoring Standard. However, when deciding who will be given credit for participating in the APM entity under the APM Scoring Standard for MIPS, we ask CMS to revise its proposed policy by allowing ACOs to report quality and other necessary MIPS information on behalf of those clinicians who join the ACO mid-performance year but are not yet included on the ACO Participant List until the following year. Allowing for the ACO Entity to report quality and other necessary information the clinician will be evaluated on under MIPS aligns with the ACO’s goals to focus collectively on care transformation activities as an ACO Entity. This will allow the ACO to incorporate this clinician in improvement activities that benefit the ACO and prepare the clinician for MIPS evaluation. Additionally, we ask CMS to hold harmless from any MIPS penalties those clinicians who join an ACO mid-year and therefore will not be included on the ACO participant list until the following calendar year, such as the Next Generation ACO Model. These clinicians should not be penalized for the hard work they will contribute to the ACO program goals during the year solely because they joined the ACO after the start of the performance year.

MIPS APM Reporting Period

Key recommendation:

As stated above, we are deeply concerned about the timing of when CMS would notify an APM of its QP determination. CMS states it expects this notification would likely occur during the summer following the close of the performance period. This means that an APM would not know if it met the QP threshold, and was thus exempt from MIPS for the prior year reporting, until well after the performance period ends.

Therefore, to ensure they are not subject to a substantial cut in Part B reimbursement for failing to report under MIPS, all clinicians who believe they are in the Advanced APM must still report for MIPS. This causes undue burden for ACOs and appears to be an unintended consequence of CMS’s proposed timeline. CMS must calculate QP thresholds and notify APMs in a timeframe that allows them to report under MIPS, should they be required to do so. We urge CMS to make QP determinations in a timely manner and notify APMs of their QP status by February 1 following the performance year. Further, any MIPS reporting deadlines should be no earlier than two months following the notification of QP status.

Quality Performance Category

Key recommendation:

CMS proposes to use APM quality measure data submitted through the CMS Web Interface by ACOs participating in the MSSP and Next Generation ACO Models to evaluate performance for the MIPS quality performance category. We support CMS’s proposal to ensure that ACOs are able to continue reporting quality measures through their respective APM program to reduce administrative burdens and duplicative reporting. By allowing ACOs to continue to focus on their current quality improvement efforts through the MSSP and Next Generation ACO Models, CMS will encourage continued participation in these programs.

CMS also proposes to score the quality performance category for ACOs using MSSP benchmarks for all Web Interface reporters in MIPS. We support this decision by CMS and are encouraged by the commitment to allow ACOs to be compared to their peers who are reporting on similar measures in the MIPS program.

CMS should also clarify that MSSP and Next Generation ACOs would not be evaluated on the proposed MIPS population measures for purposes of the MIPS APM Scoring Standard.

Resource Use Performance Category

Key recommendation:

NAACOS appreciates CMS’s desire to reduce duplicative measurement by reweighting the resource use category to zero. Making this change will allow ACOs to continue to focus on total cost of care as it is measured through the MSSP and Next Generation Program. However, we urge CMS to reweight the CPIA performance category from 15 to 25 percent to distribute the three remaining performance categories for MIPS APMs more evenly under the MIPS APM Scoring Standard. CMS’s current proposal to redistribute the resource use category weight evenly to both CPIA and Advancing Care Information (ACI) would result in an uneven distribution for the remaining categories that will apply to MIPS APMs.

Clinical Practice Improvement Activities (CPIA) Performance Category

Key recommendations:

We urge CMS to provide full credit for ACOs in this performance category, as has been proposed for qualifying Patient Centered Medical Homes. The significant focus required on clinical practice improvement in an ACO is undoubtedly satisfactory for meeting the requirements of this performance category. When looking at the list of approved activities in Table H of the proposed rule, it is clear that ACOs are very much involved in many of these activities on a daily basis to meet the stringent requirements of the MSSP and Next Generation ACO Models to achieve the goals of being accountable for total cost of care and focusing on population health. As Congress sought to recognize practices for existing improvement activities by creating this new performance category in MIPS, we feel it is only appropriate to allow ACOs to earn that credit in this category in a way that is not administratively burdensome. Section 1848(q)(5)(C)(ii) of the Act requires that MIPS eligible clinicians participating in APMs, which are not Patient Centered Medical Homes for a performance period, shall earn a minimum score of one-half of the highest potential score for CPIA. We believe this provides CMS with the authority to attribute more points to ACOs in this category beyond the minimum established by Section 1848(q)(C)(ii). Therefore, we urge CMS to provide ACOs with full credit for this performance category.

Alternatively, should CMS maintain its currently proposed policy of providing ACOs with half of the total available CPIA points, CMS must, at a minimum, allow for a simple and straightforward way for ACO Entities to attest that their eligible clinicians have been involved in improvement activities for at least 90 days in the performance year by merely being a part of the ACO Entity. CMS proposes that MIPS eligible clinicians in MSSP would submit this data through their respective ACO participant billing TINs. Scores from all of the ACO participant billing TINs would then be averaged to a weighted mean MIPS APM Entity-level score. Next Generation ACOs would be required to report this information individually, and they would have the group’s score aggregated and averaged to yield one ACO score. We support the proposal to provide one ACO Entity-level score for this category. However, NAACOS is concerned that CMS’s current proposal places undue administrative burden on ACOs that will be required to track, report and follow-up on attestations for each MIPS eligible clinician in an ACO to earn full credit for this category.

Because CMS will not be able to make QP determinations until after the performance and reporting periods close, all ACOs will need to have their eligible clinicians complete these activities and maintain the necessary documentation proving that these activities have been completed throughout the performance year regardless of what their QP status ultimately is determined to be. Although CMS proposes an option for allowing group attestations for CPIA, it is unclear how this would work practically, particularly for those large, multi-specialty groups with multiple practice sites. CMS also notes that CPIA reporting may be done via the Web Interface; however, it is not clear that information would be incorporated into existing Web Interface reporting by ACOs. Adding measures to the current ACO Web Interface measure set would be administratively complex and would force ACOs to restructure current quality reporting efforts and data collection activities. Asking ACOs to make such changes prior to the start of the 2017 performance period is

not reasonable. ACOs would have only two months to prepare prior to the start of the 2017 performance period and after the final regulation is issued.

Additionally, as stated above we do not support CMS’s proposal to reweight the ACI category for MIPS APMs to 30 percent, and instead we ask CMS to reweight the CPIA category to 25 percent and hold the ACI performance category weight at 25 percent. Since CMS is already using MSSP and CMMI authorities [Section 1899(f) of the Act and Section 1115A(d)(1) of the Act] to waive specific statutory provisions related to MIPS reporting and scoring, we feel this reweighting would be appropriate and would more accurately reflect how an ACO should be measured in MIPS, should they not meet QP or Advanced APM status. As stated above, this also creates a more even distribution of the three remaining categories MIPS APMs will be scored on under the MIPS APM Scoring Standard.

In summary, as proposed the CPIA performance category has the potential to add a significant burden on ACOs that are actively engaged in practice improvement efforts on a daily basis as part of their MSSP and Next Generation ACO participation. It is critical that CMS incentivize physician participation in APMs. By placing undue administrative burdens on MIPS APMs in this category, we fear CMS is creating a disincentive for providers to participate in APMs.

Advancing Care Information (ACI) Performance Category

Key recommendations:

As stated above, we do not support CMS’s proposal to reweight the ACI performance category for MIPS APMs to 30 percent and instead ask CMS to reweight the CPIA section to 25 percent and hold the ACI performance category weight at 25 percent. This would create a more even distribution of the three remaining performance categories MIPS APMs will be scored on under the MIPS APM Scoring Standard.

APM considerations in ACI performance category

Physicians and other health care providers who participate in alternative payment models lead the nation on utilizing health care information technology for the benefit of their patients. Advancing care information creates a unique opportunity to recognize these innovations and reward innovative physicians and providers. First, we recommend that CMS recognize that the health information technology work in most APMs is best measured as a whole allowing eligible clinicians participating in APMs to report ACI as an

ACO Entity. Analogous to what CMS proposes under the quality aspect of the composite performance score for MIPS, we believe that not only would this reduce administrative burden, but also it would more accurately measure how care information is advanced by APMs rather than merely combining the score of individual eligible clinicians. For example, an ACO may focus patient engagement through the primary care practices funneling information from specialists to patients through the certified EHR technology of the primary care physician; measured at the individual clinician level, this may create artificially high scores for the primary care practice and artificially low scores for the specialty practice.

Second, we recommend that CMS recognize the efforts made by many organizations engaged in APMs to ensure the availability of population health tools and safety of care transitions. We recommend that this recognition come in the form of 20 possible bonus points available to eligible clinicians in APMs for implementing two of the most important tasks in any population health effort. For consistency, we adopted the CMS proposal of half of the points for use and half of the points for performance.

|

Goal |

Measure |

Points |

|

Maximizing care information available for population health |

Successful integration of clinical information from a certified EHR technology and claims information from payers into a population health platform |

5 points |

|

Percent of eligible clinicians whose clinical information is integrated into the population health platform |

Percentage of 5 points |

|

|

Safety and Quality of Care Transitions through awareness |

Successful integration of admission, discharge and transfer event notifications from a hospital into the population health platform within 48 hours of the event |

5 points |

|

Percent of patients attributed to the APM with an event when the notification of the event is integrated into the population health platform within 48 hours of the event |

Percentage of 5 points |

These points should be bonus points instead of replacing existing ACI points to recognize that not all APMs are capable of these advanced integrations. By utilizing the bonus points, CMS would recognize those eligible clinicians participating in APMs that are able to go beyond the proposals laid out by CMS in their proposal for ACI while not penalizing eligible clinicians who are not yet capable of these cutting edge integrations.

Reporting and assessment

CMS proposes all MIPS eligible clinicians participating in the APM Entity group would submit ACI measures according to MIPS requirements, and performance would be assessed as a group through the billing TINs associated with the ACO for MSSP. All of the ACO participant group billing TIN scores will be aggregated as a weighted average to yield one ACO group score. We support CMS’s proposal to provide the ACO with one ACO Entity-level score. CMS also proposes a group reporting option in addition to scoring the ACI category at the ACO Entity level. We seek clarification on how the group reporting would occur, particularly for ACOs. CMS must allow for a simple group reporting and attestation process for ACOs at the ACO Entity level.

Impact on existing Meaningful Use requirement in MSSP