NAACOS Analysis of the Final 2019 Medicare Physician Fee Schedule

Executive Summary

In early November, the Centers for Medicare & Medicaid Services (CMS) released the final 2019 Medicare Physician Fee Schedule (MPFS) rule and related MPFS factsheet and Quality Payment Program (QPP) factsheet. This regulation includes a number of policies affecting Medicare physician payment, quality measure changes for Medicare Shared Savings Program (MSSP) ACOs and QPP requirements for 2019. In addition to payment policies, this regulation also includes a number of final policies previously included in the ‘Pathways to Success’ rule, which made significant proposed changes to the MSSP. NAACOS has developed a separate resource outlining key MSSP Pathways to Success policies contained in the MPFS rule including details regarding the six-month agreement extension option, changes to certain patient attribution methodologies, and updates to the extreme and uncontrollable circumstances policies for ACOs.

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) included annual 0.5 percent increases to the Medicare conversion factor through 2019. This increase as well as other statutory requirements and CMS’s final policies results in a projected conversion factor of $36.04 for 2019, which is a minor increase from the $35.99 conversion factor included in the 2018 final MPFS. Some of the key issues affecting ACOs are shown below and further detailed in the analysis.

Medicare Physician Fee Schedule Policies

Quality Payment Program Policies

Medicare Physician Fee Schedule Policies

Evaluation and Management Visits

According to CMS, in total E/M visits comprise approximately 40 percent of allowed charges for MPFS services, and office/outpatient E/M visits comprise approximately 20 percent of allowed charges for MPFS services. The agency has long acknowledged the need to revise payment, guidelines, and documentation requirements for billing E/M services, and CMS introduced a significant overhaul of these services in the proposed 2019 MPFS. The magnitude of the proposed changes and the pace of implementation were met with concern from NAACOS and the broader provider community. In response to the many concerned comments CMS received, the agency makes significant changes in the final 2019 MPFS and delays some of the notable payment changes until 2021. The agency plans to continue to solicit feedback from stakeholders before 2021, meaning there are likely to be further changes in future rulemaking before the 2021 implementation. Below is a summary of the notable policies finalized in the 2019 MPFS.

2019 Documentation Changes

Currently, for coding and billing E/M visits to Medicare, practitioners may use one of two versions of the E/M Documentation Guidelines for a patient encounter, commonly referenced based on the year of their release: the “1995” or “1997” E/M Documentation Guidelines. Stakeholders have long maintained that all of the E/M documentation guidelines are administratively burdensome and outdated with respect to the practice of medicine. For calendar year (CY) 2019 and 2020, CMS will continue the current coding and payment structure for E/M office/outpatient visits so practitioners will continue to use either the 1995 or 1997 E/M Documentation Guidelines, with the exception of a modified policy that eliminates redundant data recording. CMS finalized several policies designed to alleviate provider burdens associated with E/M documentation, effective January 1, 2019. Specifically, the agency finalized proposals related to alleviating burdens for home visit documentation and redundant data recording, as described in more detail below.

Under existing policy, Medicare pays for E/M visits furnished in the home under Current Procedural Terminology (CPT) codes 99341 through 99350, and the payment rates for these codes are slightly more than for office visits. While the beneficiary need not be confined to the home to be eligible for such a visit, there is a Medicare Claims Processing Manual provision requiring that the medical record must document the medical necessity of the home visit made in lieu of an office or outpatient visit. CMS finalized its proposal to remove the requirement that the medical record must document the medical necessity of furnishing the visit in the home rather than in the office, as proposed, effective January 1, 2019.

In response to feedback about providers having to repeatedly document information, CMS finalized its proposal to simplify the documentation of history and exam for established patients for E/M office/outpatient visits, as proposed. Accordingly, when relevant information is already contained in the medical record, practitioners may choose to focus their documentation on what has changed since the last visit, or on pertinent items that have not changed, and they need not re-record the defined list of required elements if there is evidence that the practitioner reviewed the previous information and updated it as needed. CMS notes that practitioners should still review prior data, update as necessary, and indicate in the medical record that they have done so. Further, CMS finalized its proposal that for new and established patients for E/M office/outpatient visits, practitioners need not re-enter in the medical record information on the patient’s chief complaint and history that has already been entered by ancillary staff or the beneficiary. The practitioner may simply indicate in the medical record that he or she reviewed and verified this information. These changes are effective January 1, 2019, and the agency notes that these policy changes are optional for practitioners who may also wish to continue the current documentation processes, though they are no longer required to do so by Medicare.

2021 Documentation and Payment changes

In response to considerable stakeholder feedback, CMS is finalizing modified changes in payment, coding, and associated documentation rules for office/outpatient E/M visits for 2021. These changes are a notable departure from what was proposed as is the delayed implementation timeframe. Specifically, CMS will implement a reduction in the current payment variation in office/outpatient E/M visit levels by paying a single rate for office/outpatient E/M visit levels 2, 3, and 4 (one for established and another for new patients) beginning in 2021. However, the agency did not finalize the inclusion of office/outpatient E/M level 5 visits in the single payment rate, to better account for the care and needs of particularly complex patients.

CMS also finalized separate, add-on codes that could be billed with the collapsed levels 2 through 4 E/M codes to adjust payment for new and established E/M office/outpatient visits to account for inherent complexity in primary care and non-procedural specialty care as well as separate payment for extended visits via the Healthcare Common Procedure Coding System (HCPCS) G-codes. The code descriptors for the first two are detailed in Tables 22 and 23 on page 59645 and shows that CMS finalized equal input values for these codes. The add-on code GPR01 for extended services is further detailed in Table 24A on page 59649. The agency did not finalize a concerning proposal that would have reduced payment when office/outpatient E/M visits are furnished on the same day as certain procedures, among others. Importantly, CMS recognizes that the American Medical Association (AMA) and the CPT Editorial Board, along with other stakeholders, intend to evaluate coding for E/M office/ outpatient services in the near future, and CMS notes it may consider feedback from these efforts in future rulemaking during the two-year implementation delay.

Also beginning in 2021, for E/M office/outpatient levels 2 through 5 visits, CMS will allow for flexibility in how visit levels are documented, specifically a choice to use the current framework, medical decision making or time. For E/M office/outpatient level 2 through 4 visits, beginning in 2021 CMS will also apply a minimum supporting documentation standard associated with level 2 visits when practitioners use the current framework for medical decision making (MDM) to document the visit. If choosing to document using time, for MPFS payment purposes CMS will require the billing practitioner to document that the visit was medically reasonable and necessary and that the billing practitioner personally spent the current typical time for the CPT code reported (e.g., 15 minutes when reporting CPT code 99213, which is a level 3 established patient visit).

For level 5 visits, for MPFS payment purposes a practitioner will be able to use the current framework with the documentation requirements applicable to a level 5 visit or the current definition of level 5 MDM. As an alternative, the practitioner can document using time, which will require documentation of the medical necessity of the visit and that the billing practitioner personally spent at least the typical time associated with the level 5 CPT code that is reported face-to-face with the patient (40 minutes for an established patient and 60 minutes for a new patient).

Teaching Physician Documentation Requirements for E/M Services

CMS is streamlining teaching physician documentation requirements for E/M services. Previously, Medicare Part B payment under the MPFS for teaching physician services was contingent on documentation of the teaching physician’s participation in the review and direction of services performed by residents. For E/M visits, the teaching physician was required to personally document their participation in the medical record, which was burdensome and often duplicative of other notes. CMS finalized changes to provide that, apart from specific services furnished hospital outpatient and ambulatory settings, renal dialysis services, and psychiatric services, the presence of the teaching physician during procedures and E/M services may be demonstrated by the notes in the medical record by other members of the medical team. Therefore, teaching physicians are no longer required to document the extent of their participation in the review and direction of services furnished to each beneficiary and this may be documented by the notes in the medical records made by a physician, resident, or nurse. However, the agency notes that the teaching physician continues to be responsible for reviewing and verifying the accuracy of notations included by residents and members of the medical team, along with further documenting if the notations did not accurately demonstrate the teaching physician’s involvement in an E/M service.

Medicare Shared Savings Program Quality Measure Changes

As part of the agency’s Meaningful Measures Initiative, CMS made several changes to the MSSP quality measure set for 2019 to reduce duplication and focus more on outcomes measures. As a result of these changes, CMS reduced the current quality measure set from 31 measures in 2018 to 23 required measures in 2019. Specifically, CMS removed 10 measures while adding two measures, as outlined in Table 26 in the final rule on pages 59714-59715. Additionally, in this regulation CMS finalized a provision proposed in the Pathways to Success rule, which removes ACO-11, the quality measure which focuses on the ACO’s use of CEHRT. These changes are described in further detail below.

Changes to CAHPS Measures

CMS adds the following CAHPS measures:

These measures are currently collected in the CAHPS for ACOs Survey, but ACOs are not scored on such measures at this time and instead are given feedback on the scores for informational purposes only. Beginning in 2019, all MSSP ACOs will be scored on such measures going forward. As is the case for all newly introduced measures, these measures will be pay-for-reporting for all ACOs for two years (performance years 2019 and 2020). The measures would then phase into pay-for-performance beginning in performance year 2021.

Other Measure Changes

CMS removes the following quality measures for MSSP ACOs:

Although CMS removed ACO-44, Use of Imaging Studies for Low Back Pain, the agency will continue to provide ACOs with feedback on their imaging use via the quarterly claims-based quality reports. Because CMS removed ACO-41, Diabetes Eye Exam, from the diabetes composite included in the MSSP measure set, ACO-27, Diabetes HbA1c Poor Control, will now be assessed as an individual measure. As discussed above, in this regulation, CMS also finalized the removal of ACO-11, Use of CEHRT and instead will rely on attestations regarding the ACO’s CEHRT use in 2019 and going forward.

New CEHRT Requirements for ACOs in the Absence of ACO-11

In the absence of ACO-11, CMS will require ACOs to certify annually that the percentage of ECs participating in the ACO that use CEHRT to document and communicate clinical care to their patients or other health care providers meets or exceeds the applicable percentage during the performance year. ACOs will be required to submit this certification in the form and manner specified by CMS for performance years starting on January 1, 2019, and all subsequent performance years. For performance years starting on January 1, 2019, the annual certification will occur in the spring of 2019 for ACOs extending their participation agreement for six months, and in the fall of 2019 for ACOs that have a 12-month performance year during 2019. Further, ACOs participating in Advanced APM would be required to demonstrate that the percentage of eligible clinicians in the ACO using CEHRT to document and communicate clinical care to their patients or other health care providers meets or exceeds the percentage specified in the CEHRT use criterion for Advanced APMs under QPP requirements (75 percent for 2019).

ACOs in a track that is not designated as an Advanced APM must certify annually that at least 50 percent of the eligible clinicians participating in the ACO use CEHRT to document and communicate clinical care to their patients or other health care providers. This final policy does not affect the previously finalized requirements for MIPS eligible clinicians reporting on the Promoting Interoperability (PI) performance category under MIPS. Therefore, MIPS eligible clinicians who are participating in ACOs under a payment track that is not an Advanced APM and/or who are not QPs would continue to be required to report as usual on the PI performance category.

Finally, the agency noted that it reserves the right to monitor, assess, and/or audit an ACO’s compliance with respect to its certification of CEHRT use among its participating eligible clinicians, consistent with §§425.314 and 425.316, and to take compliance actions (including warning letters, corrective action plans, and termination) as set forth at §§425.216 and 425.218 when ACOs fail to meet or exceed the required CEHRT use thresholds.

Table 26: Measure Set for Use in Establishing the Shared Savings Program Quality Performance Standard, Starting with Performance Years during 2019

|

Domain |

ACO Measure # |

Measure Title |

New Measure |

NQF #/ Measure Steward |

Method of Data Submission |

Pay for Performance Phase-In R – Reporting P – Performance PY1 PY2 PY3 |

||

|

AIM: Better Care for Individuals |

||||||||

|

Patient/ Caregiver Experience |

ACO – 1 |

CAHPS: Getting Timely Care, Appointments, and Information |

|

NQF N/A AHRQ |

Survey |

R |

P |

P |

|

ACO – 2 |

CAHPS: How Well Your Providers Communicate |

|

NQF N/A AHRQ |

Survey |

R |

P |

P |

|

|

ACO – 3 |

CAHPS: Patients’ Rating of Provider |

|

NQF N/A AHRQ |

Survey |

R |

P |

P |

|

|

ACO – 4 |

CAHPS: Access to Specialists |

|

NQF #N/A CMS/AHRQ |

Survey |

R |

P |

P |

|

|

ACO – 5 |

CAHPS: Health Promotion and Education |

|

NQF #N/A AHRQ |

Survey |

R |

P |

P |

|

|

ACO – 6 |

CAHPS: Shared Decision Making |

|

NQF #N/A AHRQ |

Survey |

R |

P |

P |

|

|

ACO – 7 |

CAHPS: Health Status/Functional Status |

|

NQF #N/A AHRQ |

Survey |

R |

R |

R |

|

|

ACO – 34 |

CAHPS: Stewardship of Patient Resources |

|

NQF #N/A AHRQ |

Survey |

R |

P |

P |

|

|

ACO – 45 |

CAHPS: Courteous and Helpful Office Staff |

X1 |

NQF #N/A AHRQ |

Survey |

R |

R |

P |

|

|

ACO – 46 |

CAHPS: Care Coordination |

X1 |

NQF #N/A AHRQ |

Survey |

R |

R |

P |

|

|

Care Coordination/Patient Safety |

ACO – 8 |

Risk-Standardized, All Condition Readmission |

|

Adapted NQF #1789 CMS |

Claims |

R |

R |

P |

|

|

ACO – 38 |

Risk-Standardized Acute Admission Rates for Patients with Multiple Chronic Conditions |

|

NQF#2888 CMS |

Claims |

R |

R |

P |

|

|

ACO – 43 |

Ambulatory Sensitive Condition Acute Composite (AHRQ Prevention Quality Indicator (PQI) #91) (version with additional Risk Adjustment)2 |

|

AHRQ |

Claims |

R |

P |

P |

|

|

ACO – 13 |

Falls: Screening for Future Falls |

|

NQF #0101 NCQA |

CMS Web Interface |

R |

P |

P |

|

AIM: Better Health for Populations |

||||||||

|

Preventive Health |

ACO – 14 |

Preventive Care and Screening: Influenza Immunization |

|

NQF #0041 AMA-PCPI |

CMS Web Interface |

R |

P |

P |

|

ACO – 17 |

Preventive Care and Screening: Tobacco Use: Screening and Cessation Intervention |

|

NQF #0028 AMA-PCPI |

CMS Web Interface |

R |

P |

P |

|

|

ACO – 18 |

Preventive Care and Screening: Screening for Depression and Follow-up Plan |

|

NQF #0418 CMS |

CMS Web Interface |

R |

P |

P |

|

|

ACO – 19 |

Colorectal Cancer Screening |

|

NQF #0034 NCQA |

CMS Web Interface |

R |

R |

P |

|

|

ACO – 20 |

Breast Cancer Screening |

|

NQF #2372 NCQA |

CMS Web Interface |

R |

R |

P |

|

|

ACO – 42 |

Statin Therapy for the Prevention and Treatment of Cardiovascular Disease |

|

NQF #N/A CMS |

CMS Web Interface |

R |

R |

R |

|

|

Clinical Care for At Risk Population – Depression |

ACO – 40 |

Depression Remission at Twelve Months |

|

NQF #0710 MNCM |

CMS Web Interface |

R |

R |

R |

|

Clinical Care for At Risk Population – Diabetes |

ACO-27 |

Diabetes Hemoglobin A1c (HbA1c) Poor Control (>9%)) |

|

NQF #0059 NCQA |

CMS Web Interface |

R |

P |

P |

|

Clinical Care for At Risk Population – Hypertension |

ACO – 28 |

Hypertension : Controlling High Blood Pressure |

|

NQF #0018 NCQA |

CMS Web Interface |

R |

P |

P |

Chronic Care Management Services

For CY 2019, the CPT Editorial Panel created CPT code 99491 (chronic care management services, provided personally by a physician or other qualified health care professional, at least 30 minutes of physician or other qualified health care professional time, per calendar month, with the following required elements: multiple [two or more] chronic conditions expected to last at least 12 months, or until the death of the patient, chronic conditions place the patient at significant risk of death, acute exacerbation/decompensation, or functional decline; comprehensive care plan established, implemented, revised, or monitored) to describe situations when the billing practitioner is personally doing the care coordination work attributed to clinical staff in CPT code 99490. CMS is adding this new CCM code to the MPFS effective January 1, 2019, and in response to comments from NAACOS and other stakeholders, CMS finalized a higher work relative value unit (RVU) than proposed for this code.

Medicare Telehealth, Remote Patient Monitoring, and Communication Technology-Based Services

CMS finalized with no significant changes several new opportunities for telehealth, remote patient monitoring, and Communication Technology-Based Services. CMS in rulemaking states it doesn’t believe Section 1834(m) of the Social Security Act, which sets rather strict limits on what types of telehealth services Medicare covers, applies to all kinds of physician services. It instead applies to a discrete set of services that were furnished as if they took place during an in-person exam. The distinction is notable in that it allows CMS to pay for visits in a newly defined category the agency is calling Communication Technology-Based Services.

“Virtual Check-Ins”

Starting January 1, 2019, CMS will pay for brief, five-to-10 minute “virtual check-ins” with established patients through real-time telephone calls and video chats (HCPCS code G2012). The visits, which must be with a billing practitioner, are intended to evaluate if an office visit is warranted —quick, one-off medical questions and condition assessments. As such, the check-ins cannot be tied to a separate office visit provided within the previous seven days or within the next 24 hours or soonest available appointment. If the check-ins are connected or result in an office visit, they would be bundled with that E/M code. Despite NAACOS advocacy, CMS says it will not waive copay requirements, and verbal patient consent must be obtained and noted in the medical record for each billed service. CMS set an average payment rate of $15.14 and will monitor the code’s use for possible overutilization.

Remote Evaluations

Also starting next year, CMS will pay for the evaluation of patient-submitted images and video (HCPCS code G2010). Like with the virtual check-ins, this would be used to determine if an office visit is warranted. These are with established patients and verbal follow-up is required within 24 hours. Following NAACOS’ calls, CMS states follow-ups can take place through a range of modalities like phone call, video chats, text messaging, email, or a patient portal. Other restrictions placed on virtual check-ins also apply to this code, such as not being tied to a visit in the last seven days or next 24 hours, requiring it be done by a billing practitioner, and needing verbal consent that must be noted in the patient record. CMS set an average payment rate of $12.98, and patient cost-sharing requirements still apply.

Interprofessional Consults

After support from NAACOS, CMS finalized six new billing codes that allow interprofessional consultations performed via telephone, internet or EHRs (CPT codes 99451, 99452, 99446, 99447, 99448, and 99449). The agency states paying for these consults, which must have patients’ verbal consent, will facilitate team-based care and eliminate separate, costly, inconvenient visits if treating providers consult with outside specialists.

Other Telehealth Changes

The agency is adding three new codes to the list of chronic care remote physiologic monitoring CPT codes reimbursable under Medicare (CPT codes 99453, 99454, and 99457). These new codes include remote monitoring of a wireless pulmonary artery sensor and physiologic measures such as weight, blood pressure, and pulse oximetry. CMS plans future guidance on what types of devices can be used in remote monitoring like smartphones or smartwatches. New codes also reimburse for initial set-up and patient education on the remote monitoring equipment provided by the health care professional. But CMS clarifies that remote patient monitoring can be furnished by clinical staff, not just physicians. NAACOS was part of a broader group supporting these new codes from CMS.

As supported by NAACOS, CMS is adding new telehealth codes for preventive services requiring direct patient contact beyond the usual service in the first 30 minutes (G0513) and each additional 30 minutes (G0514).

Per the Bipartisan Budget Act of 2018, CMS finalized proposals to allow an individual determined to have end-stage renal disease (ESRD) receiving home dialysis to choose to receive certainly monthly ERSD-related clinical assessments via telehealth. Medicare will also remove geographic restrictions on the locations and types of originating sites where acute stroke telehealth services can be finished. NAACOS was supportive of each of these moves in its comments on the proposed rule. CMS clarified in the final rule that it will allow mobile stroke units to qualify for reimbursement, but it is adding a new modifier that must be used to identify acute stroke telehealth services.

Following October’s enactment of the Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment (SUPPORT) for Patients and Communities Act, CMS is moving to allow patients’ homes as acceptable originating sites of care for telehealth services for substance use disorder of care starting July 1, 2019. CMS notes it may issue additional guidance in the future for billing these telehealth services. Additional details on many of the ACO-related provisions of the SUPPORT Act can be found here.

Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs)

CMS finalized new billing codes for RHCs and FQHCs for the same virtual check-ins and remote evaluations finalized in the MPFS (HCPCS code G0071). The same rules apply in terms of not having a related office visit in the previous seven days or not related to a visit in the next 24 hours. Payment will be set to the average of the national non-facility MPFS payment rates for HCPCS codes G2012 and G2010. RHCs and FQHCs would be able to bill the virtual communication G-code either alone or with other payable services.

CMS also proposes to update the payment for a CCM code introduced in 2018, General Care Management code G0511, to reflect the input of the new CCM code 99491 starting in 2019. This NAACOS resource from 2017 updates change to chronic care management for FQHCs and RHCs.

Determination of Work, Practice Expense (PE), and Malpractice Relative Value Units (RVUs)

As is typical in the MPFS, CMS finalized its 2019 work and PE RVU update proposals. The agency added two new specialties to this process, hospitalists and advanced heart failure and transplant cardiology, as these specialties were recognized by Medicare in the past year. CMS also proposed a new direct PE input methodology for pricing of certain supplies and equipment, which the agency would phase in over four years. As part of this process, CMS finalized its proposal to use invoice data as a factor in establishing prices for certain new and existing equipment and supplies. In stating its belief that updating prices with a 4-year phase-in will improve payment accuracy and maintain stability, CMS noted that in some cases, changes to PE values could have implications for reimbursement of certain CPT codes.

Where CMS establishes prices based on invoices submitted by the public for existing supply and equipment codes that are not part of a comprehensive review and valuation of a code family, the agency finalized its proposal to phase in the new price over the 4-year pricing transition. Where prices for new supply and equipment codes are established based on the public submission of invoices, those prices will be implemented with no transition since there are no current prices for these supply and equipment items. The pricing updates for a majority of existing supply and equipment codes will be phased in using the four-year transition, except those existing codes that are priced based on invoices submitted as part of a revaluation or comprehensive review of a code or code family. Those codes will be fully implemented without being phased in over the 4-year pricing transition. Finally, in response to comments on the proposed rule, CMS finalized immediate changes to the proposed pricing of approximately 60 supply and equipment codes, which will take effect in 2019.

Depending on the types of supply and equipment codes billed by ACO practitioners, these reimbursement changes could cause unexpected variation between an ACO’s costs and its historical benchmark unrelated to its actual performance. ACOs should review the modified reimbursement for updated codes to assess whether the revised values will change their ability to earn savings (or the size of savings).

Potentially Misvalued Services

As is typical in this annual rulemaking, CMS reviewed certain potentially misvalued services. CMS finalized a decision to review seven potentially misvalued codes, including CPT codes for arthroplasty, computerized tomography (CT), colonoscopy, and electrocardiogram codes. CMS reiterated that it does not believe that the inclusion of a code on the potentially misvalued code list necessarily means that a particular code is misvalued, but rather that the list is intended to prioritize codes for review under the misvalued code initiative.

CMS also discussed its policy to collect postoperative visit data. Beginning July 1, 2017, CMS required practitioners in groups with 10 or more practitioners in nine states (Florida, Kentucky, Louisiana, Nevada, New Jersey, North Dakota, Ohio, Oregon, and Rhode Island) to use the no-pay CPT code 99024 to report a postoperative visit. In response to CMS’s query about this data collection in the proposed 2019 MPFS, the agency is evaluating the public comments received and considering whether to propose action at a future date. CMS also sent a letter describing the data collection requirement to practitioners who are required to report in the nine affected states.

Physician Self-Referral (Stark) Law

CMS finalized modifications of certain writing and signature requirements for the compensation arrangements exception of the Stark Law in accordance with the Bipartisan Budget Act (BBA) of 2018. While these modifications do not represent novel changes to the Stark Law, they conform the Stark Law regulations to the recently added statutory provisions codified under the BBA. Section 1877 of the Social Security Act prohibits a physician from referring a Medicare beneficiary for certain designated health services (DHS) to an entity with which the physician (or a member of the physician’s immediate family) has a financial relationship, unless an exception applies. The scope of the four DHS categories is defined in a list of CPT/HCPCS Codes which is updated annually to account for changes in the most recent CPT and HCPCS Level II publications. Tables 28 and 29, on page 59718, in the final rule identify the additions and deletions to the comprehensive code list that becomes effective January 1, 2019. The updated comprehensive code list effective January 1, 2019 is available on the CMS website here.

Therapy Services

CMS finalized a number of changes to payment policies related to occupational therapy and physical therapy. First, CMS is discontinuing the functional status reporting requirements for services furnished on or after January 1, 2019. Second, CMS implemented technical policies regarding a provision of the BBA that provides payment for occupational therapy assistant (OTA) and physical therapy assistant (PTA) services (85 percent of the applicable Part B payment amount). CMS finalized policies regarding two new payment modifiers to be used when an OTA or PTA performs a service.

Payment Rates under the MPFS for Nonexcepted Items and Services Furnished by Nonexcepted Off-Campus Provider-Based Departments (PBDs) of a Hospital

CMS is continuing its efforts to equalize payments between provider-based entities and physician practices. Building on policies implemented in the past few years, CMS will continue to allow nonexcepted off-campus PBDs to bill for nonexcepted items and services on an institutional claim using a modifier (PN) and will apply a MPFS Relativity Adjustor of 40 percent for CY2019. The agency recently made adjustments to the MPFS Relativity Adjustor based on new data. CMS will also maintain the 40 percent adjustment for future years until new information is available, at which time the agency would formally propose changes through the regulatory process.

Geographic Practice Cost Indices

CMS updates the geographic practice cost indices (GPCIs) every three years and the next update will occur in 2020. CMS did not respond to specific comments submitted for the proposed rule and will address GPCIs in a more meaningful way in the 2020 MPFS rule.

Appropriate Use Criteria (AUC) for Imaging Services

In the final rule, CMS clarified its definition of who may conduct appropriate use consults to allow “clinical staff” under the direction of an ordering professional rather than “auxiliary personnel,” as originally proposed. CMS said “clinical staff” is well defined in other Medicare regulations, whereas the “auxiliary personnel” caused confusion amongst stakeholders who commented on the change. CMS did finalize changes to expand the requirement of appropriate use consults to independent diagnostic testing facilities and modify the significant hardship exception requirements under this program, which becomes mandatory starting in 2020. More information on the AUC Program can be found in our 2018 MPFS analysis.

Part B Drug Payments

Despite comments from NAACOS and others objecting to the move, CMS will cut the add-on fee for certain Part B drugs from 6 percent to 3 percent for wholesale acquisition cost-based payments. The 3 percent add-on would apply to newer drugs for which an average sales price —which determines Medicare payments for drugs and resulting add-on payment for providers —is based. CMS contends the move would apply to only a small slice of new drugs and is consistent with a recommendation from the Medicare Payment Advisory Commission. The agency also states wholesale acquisition costs are often higher than a drug’s average sales price, resulting in inflated add-on payments for providers.

QUALITY PAYMENT PROGRAM CHANGES

MIPS Policies

Overview

CMS finalized a number of changes to MIPS for 2019, increasing the performance thresholds in the program while continuing to exempt a significant number of clinicians through the “low volume” exception. Notably, CMS did not significantly change the APM Scoring Standard, which is used to evaluate ACOs subject to MIPS. Therefore, ACOs will continue to receive favorable benefits from their APM participation in MIPS such as no additional quality reporting, no Improvement Activities Performance Category reporting, and no cost evaluation. NAACOS projects that ACOs will continue to be among the top performers in MIPS based on these final policies. Notably, CMS finalized a number of significant changes to the Promoting Interoperability (PI) performance category, including a requirement to move to 2015 CEHRT beginning in 2019.

Comparison of Performance Category Weights for ACOs vs. MIPS ECs 2018 and 2019

|

|

ACOs |

ACOs |

MIPS ECs |

MIPS ECs |

|

PY 2018 |

PY 2019 |

PY 2018 |

PY 2019 |

|

|

Quality |

50% |

50% |

50% |

45% |

|

Cost |

0% |

0% |

10% |

15% |

|

Improvement Activities |

20% |

20% |

15% |

15% |

|

Promoting Interoperability |

30% |

30% |

25% |

25% |

MIPS Performance Thresholds

CMS increased the MIPS performance threshold from 15 points for 2018 to 30 points in 2019. Therefore, an EC must meet or exceed 30 points in MIPS to avoid penalties in the program. CMS also increased the exceptional performance threshold from 70 points for 2018 to 75 points in 2019. Additional bonus opportunities are available to those that meet or exceed the exceptional performance threshold. MACRA originally required CMS to increase the MIPS performance threshold to either the mean or median performance beginning with the 2019 performance year, however the BBA gave the agency additional flexibility in raising the performance threshold over time to provide clinicians with an additional three years to transition to use of mean/median performance as the established threshold in MIPS. NAACOS has consistently urged CMS to continue its commitment to transitioning clinicians to value-based payments by increasing the performance thresholds and criteria in MIPS as required by MACRA and will continue to advocate for such going forward.

MIPS ECs and Exclusions

Eligible Clinicians

CMS modified the definition of MIPS ECs beginning in 2019 to include the following types of clinicians: physicians, physician assistants, nurse practitioners, clinical nurse specialists, certified registered nurse anesthetists, physical therapists, occupational therapists, qualified speech language pathologists and audiologists, clinical psychologists, and registered dieticians.

Low-Volume Exclusion

CMS finalized proposals to modify the timeframe used to make low-volume exclusion determinations. Beginning in 2019, the MIPS determination period would be a 24-month assessment period including a two-segment analysis of claims data consisting of: (1) an initial 12-month segment beginning on October 1 of the calendar year two years prior to the applicable performance period and ending on September 30 of the calendar year preceding the applicable performance period (October 1, 2017, to September 30, 2018); and (2) a second 12-month segment beginning on October 1 of the calendar year preceding the applicable performance period and ending on September 30 of the calendar year in which the applicable performance period occurs (October 1, 2018, to September 30, 2019). The first segment would include a 30-day claims run out. The second segment would not include a claims run out, but it would include quarterly snapshots for informational use only, if technically feasible. This timeframe will also be used to determine those that meet the definition of non-patient facing clinicians, hospital-based clinicians, ambulatory surgical center-based clinicians, and those determined to be a small practice.

CMS also added a criterion to the low-volume exclusion criteria. For 2019, CMS adds a “covered professional services criterion” for those who provide 200 or fewer covered professional services to Part B enrolled individuals. Therefore beginning in 2019, those who meet at least one of the three low-volume threshold criteria would be excluded from MIPS. As a reminder, CMS in 2018 finalized the remaining two criteria, which are: (1) those who see 200 or fewer Medicare patients or (2) those who have $90,000 or fewer Medicare Part B charges during the specified measurement period.

Finally, CMS created a new “opt-in option” that would allow those who meet or exceed at least one, but not all of the low volume threshold criteria, to choose to opt-in and participate in MIPS. CMS estimates between approximately 787,900 and 797,990 ECs would be subject to MIPS with the addition of the opt-in option and other final policies

Quality

ACOs will continue to be exempt from any additional quality reporting requirements in MIPS. CMS will continue to rely on the ACO’s MSSP and Next Generation Model quality reporting for purposes of MIPS.

Policy for Clinicians in ACOs Who Fail to Report Quality Measures

CMS finalized the proposal to make a slight change to its policy regarding alternative reporting options for clinicians in MIPS in the rare case that an ACO fails to report quality measures for the MSSP or Next Generation Model. Starting in 2019, when an ACO fails to report quality measures, CMS will allow an individual clinician who is also a solo practitioner to report on any available MIPS measures, including individual quality measures.

Quality Bonus Points

Currently CMS provided ACOs with bonus points for reporting Web Interface measures categorized as “high priority” by MIPS. Despite NAACOS objections, beginning in 2019, CMS will no longer award ACOs with these bonus points. CMS noted it may remove bonus opportunities for high priority measures altogether in future program years. CMS did not eliminate bonus points awarded to those who report quality using end-to-end electronic reporting.

Clinical Practice Improvement Activities

CMS did not change the way ACOs are evaluated in the Clinical Practice Improvement Activities performance category for 2019. CMS states that the agency will continue to post an evaluation annually to determine what credit is provided automatically to each APM. More information on how ACOs are currently scored in this performance category is available here. In both 2017 and 2018, ACOs do not report any improvement activities and instead are awarded full points in this category automatically.

Promoting Interoperability

CMS finalized a number of significant changes to the PI performance category. Notably, CMS will require the use of 2015 CEHRT beginning in 2019.

ACOs and PI

Beginning in 2019, CMS will allow clinicians in ACOs to report PI measures either as an individual or as a group (i.e., Taxpayer Identification Number (TIN)). Therefore, if finalized, ACOs would no longer be restricted to group/TIN level reporting for PI, though unfortunately, the agency will not allow ACO-level reporting as advocated for by NAACOS. As a reminder, in this regulation CMS removed the ACO Quality Measure ACO-11, Use of CEHRT. However, all ACOs subject to MIPS will be required to report Promoting Interoperability for MIPS. As finalized, an ACO entity could choose to have groups and/or individuals report PI measures for purposes of MIPS and must follow all MIPS PI requirements and reporting obligations.

Moving to Performance-based Measurement

CMS finalized the proposal to eliminate the previous Base Score and Performance Score components of the PI performance category score and instead move to a performance-based measurement for this category. CMS also made a number of changes to certain measures and specifications in this performance category, as outlined in the tables below. Because CMS will require the use of 2015 CEHRT beginning in 2019, the transition objectives and measures will no longer be available for 2019 and beyond.

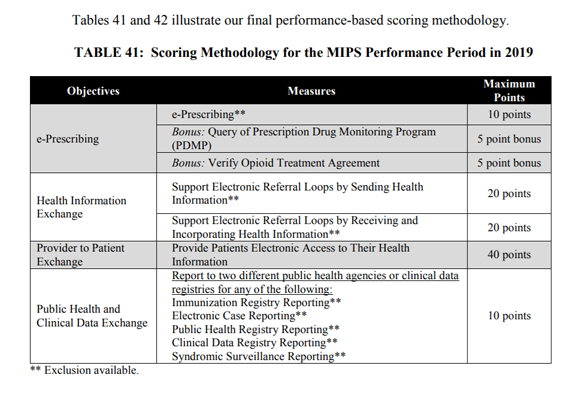

For 2019, ECs must report at least six measures across four objectives including: e-prescribing, health information exchange, provider to patient exchange, and public health/clinical data exchange. Clinicians will be scored based on their performance on each measure, worth up to 40 points each. The scores for each of the individual measures will be added together to calculate the final performance category score of up to 100 possible points. CMS also finalized the Security Risk Analysis measure as a required measure, though no points will be awarded for this measure it remains a non-optional requirement. Table 41 on page 59796 provides an overview of the final PI scoring methodology for 2019.

Finally, CMS will provide a zero PI score for nurse practitioners, physician assistants, clinical nurse specialists, certified registered nurse anesthetists, and physical therapists, occupational therapists, qualified speech language pathologists and audiologists, clinical psychologists, and registered dieticians for 2019.

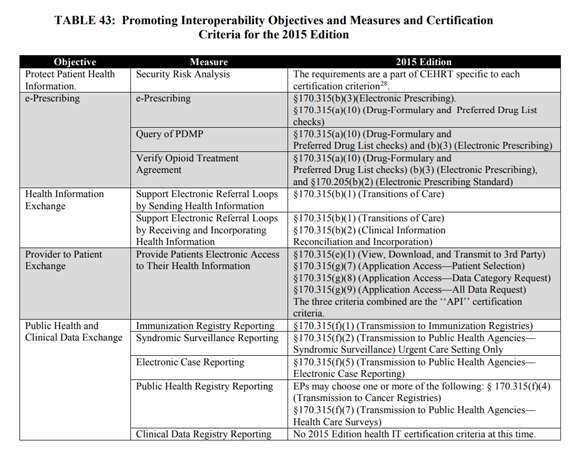

Table 43 on page 59817 summarizes the PI objectives and measures and 2015 certification criteria.

Cost

CMS did not make changes to its current policy that excludes ACOs from receiving a Cost Performance Category score in MIPS. For non-ACOs, the cost performance category weight increases from 10 percent for the 2018 performance year to 15 percent for the 2019 performance year. CMS will increase the cost performance category weight by 5 percent each year until the cost category is worth 30 percent of a MIPS EC’s overall score.

In addition to the Total Per Capita Cost and Medicare Spending Per Beneficiary measures, in 2019 CMS will begin implementing eight-episode cost measures for MIPS ECs (non-ACOs). CMS provided some ECs with feedback on these episode cost measures through select field testing completed in 2017. These measures are supported by the National Quality Forum’s Measure Applications Partnership (MAP). The episode cost measures include (see Table 36 on page 59768):

The attribution method for such measures will be made available on the CMS website. In sum, for acute inpatient medical condition episodes, CMS will attribute episodes to each EC who bills inpatient E/M claims during a trigger inpatient hospitalization under a TIN rendering at least 30 percent of the inpatient E/M claims in that hospitalization. For procedural episodes, CMS would attribute to each EC who renders a trigger service as identified by procedure codes.

Other changes

Complex Patient Bonus

CMS altered the dates used to determine eligibility for the Complex Patient Bonus to align with changes to the MIPS eligibility determination timeframe. CMS will assess eligibility for this bonus by looking at claims October 1 of the calendar year preceding the applicable performance period and ending September 30 of the calendar year in which the applicable performance period occurs.

Small Practice Bonus

Beginning in 2019, CMS will no longer award a small practice bonus, which was formerly added to final MIPS scores for those who qualify. Instead, certain small practices (i.e., fewer than 15 ECs) will be awarded bonus points to their Quality Performance Category score. ACOs were not previously eligible for this bonus given the size limitations imposed.

Final MIPS Score and Resulting Payment Adjustments

As a reminder, the MIPS 2019 performance year corresponds to 2021 payment adjustments. CMS estimated approximately $310 million will be available in the budget-neutral pool for MIPS based on these proposals, which is in addition to the $500 million in the exceptional performance incentive payment pool for those that meet or exceed the 75-point exceptional performance threshold. This amount ($310 million) is an increase from 2018 due to the fact that the maximum penalty amount in performance year 2019 rises to 7 percent from 5 percent in performance year 2018. For more information, please refer to Figure 1 on page 59734 and Figure 3 on page 59892. Based on these projections, CMS estimated those earning a perfect MIPS score of 100 in 2019 would earn a 4.7 percent MIPS payment adjustment in 2021.

CMS also noted the agency will not apply MIPS adjustments to certain model-specific payments for the duration of an 1115A model testing, beginning in 2019 such as Oncology Care Model per member per month payments. NAACOS will continue to urge CMS to reverse its current policy that counts MIPS adjustments as ACO expenditures. Finally, as a result of the BBA, CMS will not apply MIPS payment adjustments to Part B drugs.

MIPS Performance Feedback

CMS confirmed that MSSP ACOs will be able to view TIN-level performance data for MIPS. CMS also outlined the MIPS information to be displayed on the Physician Compare website including:

Advanced APM Proposals

Advanced APM Participation

CMS estimated the number of providers qualifying for Advanced APM bonuses will remain steady in the third year of the program, which includes the program year (PY) 2019 and 2021 payment adjustments. The agency estimates that between 165,000 and 220,000 clinicians will become Qualifying APM Participants (QPs) and earn bonuses. CMS projected the agency will pay aggregate 2021 Advanced APM bonuses totaling between $600 million and $800 million. CMS noted it is working to introduce new Advanced APMs, which for 2019 includes the addition of the Bundled Payments for Care Improvement Advanced Model and the Maryland Total Cost of Care (which includes the Care Redesign Program and the Maryland Primary Care Program). The agency anticipated developing several new APMs and Advanced APM.

Financial Risk Requirements

MACRA required that Advanced APMs have a certain level of financial risk, which CMS refers to as the nominal amount standard. This includes a benchmark-based standard requiring a risk level be set at or above 3 percent of the expected expenditures for which an APM Entity is responsible under the APM, or a revenue-based standard requiring risk levels be set at or above 8 percent of the average estimated total Medicare Parts A and B revenue of all providers and suppliers in a participating APM Entity. While CMS had previously considered raising the revenue-based standard above 8 percent, in this rule the agency finalized its proposal to maintain the threshold at 8 percent, a policy for which NAACOS advocated. Therefore, the revenue-based standard will remain at 8 percent through PY 2024.

Increasing the CEHRT Use Criterion

Citing continued and near widespread progress in the adoption of CEHRT, CMS finalized a policy to require at least 75 percent of ECs in each APM Entity to use CEHRT to document and communicate clinical care with patients and other health care professionals. NAACOS advocated that increasing this threshold in the same year as requiring 2015 CEHRT would be especially challenging to providers. Unfortunately, CMS noted the mandate to use 2015 CEHRT was already been delayed a year and the agency will require the use of 2015 CEHRT in 2019 as well as implement the increased CEHRT use requirement for Advanced APMs.

Quality Measures Comparable to MIPS

Advanced APMs must provide payment for covered professional services based on quality measures comparable to those under the MIPS quality performance category. These measures must include at least one outcome measure and meet criteria related to reliability and validity. In this rule, CMS finalized a clarification to its policy that beginning with PY 2020 at least one of the quality measures and one outcome measure upon which an Advanced APM bases payment must be on the final list of MIPS quality measures, be endorsed by a consensus-based entity, or otherwise determined by CMS to be evidenced-based, reliable, and valid. CMS noted this clarification does not change the status of any current APMs as qualifying as Advanced, including ACO models.

QP and Partial QP Determinations

CMS finalized its proposal to shorten the claims run-out timeframe for data used to make QP determinations from 90 days to 60 days. This change will apply to each of the three QP determination snapshot dates (March 31, June 30, and August 31) allowing QP determinations to be made more quickly, approximately three months after the snapshot date. This alters the timeframe in which claims need to be processed in order for those services to be included in calculating the QP threshold score.

For Advanced APM entities that fail to meet QP thresholds but do meet the lower Partial QP thresholds, current policy requires them to actively elect to report MIPS if they want to report and be subject to MIPS payment adjustments. If an APM Entity does not meet QP thresholds, CMS evaluates ECs individually if they participate in multiple Advanced APMs. CMS finalized its proposal to align the MIPS election policy across Partial QP APM Entities and ECs by requiring Partial QP ECs to make an election that they want to report MIPS and be subject to payment adjustments. As with Partial QP APM Entities, no election by the EC means they would be excluded from MIPS.

All-Payer Combination Option

CEHRT Use Requirements and Quality Measures

Advanced APMs are only initially evaluated based on traditional Medicare APM participation. Beginning with PY 2019, CMS will give credit for qualifying APM participation with payers outside of Medicare, including Medicare Advantage (MA), Medicaid and commercial plans. This All-Payer Combination Option or Other Payer Option has similar criteria to the Medicare Option, with a few exceptions. The All-Payer Combination Option will help providers meet rising QP thresholds which increase in PY 2019 as reflected in Tables 57 and 58 of the final rule (page 59926).

CMS finalized its proposal to change the current CEHRT use criterion for Other Payer Advanced APMs so that in order to qualify as of January 1, 2020, the Other Payer arrangement must require at least 75 percent of participating ECs in each APM Entity to use CEHRT. In response to NAACOS advocacy, CMS finalized its proposal to modify the nature by which it is demonstrated that Other Payer APMs meet the CEHRT use requirements. CMS will now allow a payer or EC to provide documentation to CMS that CEHRT is used to document and communicate clinical care under the payment arrangement by at least 50 percent of the ECs in PY 2019 and 75 percent of the ECs in PY 2020 and beyond. The flexibility to provide documentation is an improvement from the previous requirement that official contract language explicitly requiring CEHRT use be provided to CMS. The agency finalized clarifications to the Other Payer quality measure requirements. Specifically, for PY 2020 and beyond at least one of the quality measures and the outcome measure used in the qualifying Other Payer payment arrangement with an APM Entity must be on the MIPS final list of measures, be endorsed by a consensus-based entity, or be otherwise determined by CMS to be evidenced-based, reliable, and valid.

Financial Risk Requirements and Determining Other Payer APMs

CMS finalized its proposal to maintain the 8 percent revenue-based nominal amount standard for Other Payer Advanced APMs through 2024. In response to NAACOS advocacy, CMS is finalizing a more flexible policy related to annual submission and determination of whether an Other Payer APM qualifies as Advanced. Specifically, CMS will no longer require annual submission of all the information related to making this determination and will instead permit a requestor (i.e., payer, APM Entity or EC) to submit information about a multi-year payment arrangement that is determined to qualify as an Other Payer Advanced APM. Following the initial submission and approval, in subsequent years the requestor would only need to submit information on any relevant changes to the payment arrangement. For multi-year payment arrangements submissions, CMS will require that the requestor’s certifying official agree to review the submission at least annually to assess whether there have been any changes and to submit updated information notifying CMS of any changes relevant to the Other Payer Advanced APM criteria for each successive year of the arrangement. Absent a submission of updated information, CMS will continue to apply the original Other Payer Advanced APM determination until the arrangement ends or expires or it has been five years since the determination was made. NAACOS is pleased with this increased flexibility which minimizes burdens on providers and ACOs. Table 59 on page 59935 shows the updated timeframes for Other Payer payment arrangement submissions and determinations.

Public Posting of Other Payer Advanced APMs

In the rule, CMS noted that the agency intends to post a list of Other Payer Advanced APMs on a public CMS webpage prior to the start of the QP Performance Period and to update that list as new payment arrangements are approved.

Other Payer QP Calculation

CMS makes QP determinations sequentially with Medicare QP calculations first, and for those who fall short the agency would then calculate the All-Payer Combination Option QP thresholds for those submitted for review. CMS finalized its proposal to allow requests for an All-Payer QP determination at the TIN-level, which is in addition to already allowing requests at the APM Entity (i.e., ACO) or EC level. The TIN-level option is available in instances where all clinicians who have reassigned billing rights under the TIN participate in a single APM Entity, meaning it would be an option for MSSP ACOs. CMS clarifies that should the agency receive any combination of QP determination requests (e.g., at the EC, TIN or APM Entity level), the agency will make QP assessments at all levels and apply the most advantageous result. CMS clarified that the agency allows ECs or APM Entities to meet the minimum Medicare thresholds required as part of the All-Payer Combination Option using either the revenue or patient count method, but that same specific method must not be used when calculating the All-Payer QP thresholds.

Medicare Advantage Qualifying Payment Arrangement Incentive

As advocated by NAACOS, CMS finalized its proposal to aggregate Qualifying Payment Arrangements with MA plans in Advanced APM calculations for purposes of being exempt from MIPS reporting and subsequent payment adjustments. As summarized in this NAACOS resource and FAQs from CMS, under the Medicare Advantage Qualifying Payment Arrangement Incentive (MAQI) Demonstration, providers are exempt from MIPS reporting if they have at least 25 percent of payments or 20 percent of patients through Advanced APMs and/or Qualifying Payment Arrangements with MA plans. However, despite NAACOS’s ask, CMS will not provide those who surpass the threshold with a 5 percent Advanced APM bonus. CMS said in the final rule it will notify providers who applied to participate in the demonstration by December 2018 or January 2019 if they met the thresholds and therefore will be exempt from MIPS reporting for the 2018 performance year. CMS plans to allow new clinicians to apply each year of the demonstration.

1Measures that are currently collected as part of the administration of the CAHPS for ACO survey, but will be considered new measures for purposes of the pay-for-performance phase-in.

2 The language in parentheses has been added for clarity and no changes have been made to the measure.