News Release

September 11, 2018

Independent Study Shows Accountable Care Organizations (ACOs) Saved Medicare $1.84 Billion in 2013–2015

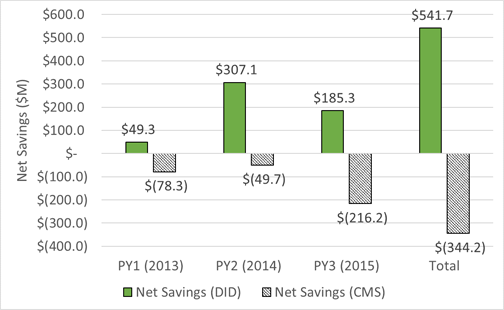

Medicare Shared Savings Program Net Savings Reached $541.7 Million for 2013–2015

After Accounting for Shared Savings Earned by ACOs

SHINGTON, D.C.—Medicare’s largest ACO initiative – the Medicare Shared Savings Program (MSSP) — where most ACOs do not bear financial risk for holding down spending — generated gross savings of $1.84 billion for Medicare in 2013–2015, nearly double the $954 million estimated by the Centers for Medicare and Medicaid Services (CMS).

MSSP ACOs reduced federal spending by $542 million after accounting for shared savings payments earned by the ACOs. The new study, which is discussed in today’s Health Affairs Blog, uses rigorous and widely accepted research methods to measure savings. This contrasts with CMS’s claims that ACOs increased Medicare spending by $344 million over the three-year time span based on administrative formulas used by the MSSP to measure performance and calculate shared savings payments (see Exhibit 1).

“The analysis should put to rest claims that shared savings only ACOs do not save Medicare money,” said Clif Gaus, Sc.D., President and CEO of the National Association of ACOs (NAACOS). “The findings confirm the wisdom of giving ACOs adequate time to build the care coordination, information technology, and data analytics capabilities needed to manage financial risk successfully.”

NAACOS commissioned Dobson DaVanzo & Associates to conduct an independent evaluation of ACO performance using rigorous and widely accepted statistical methods to analyze Medicare claims data from approximately 25 million beneficiaries per year. The study is the largest ever of ACO performance based on Medicare claims.

The Dobson DaVanzo evaluation report, titled ”Estimates of Savings by Medicare Shared Savings Program Accountable Care Organizations: Program Financial Performance 2013-2015,” is available online.

Exhibit 1: Net Federal Savings in the Medicare Shared Savings Program for 2013–2015: Dobson DaVanzo Analysis versus CMS Benchmark Methodology

Source: Dobson | DaVanzo (D|D) analysis of ACO RIF Data, CMS DUA 28643, and CMS MSSP Public Use Files, 2013–2015

Most experts agree that moving from volume-driven fee-for-service payment to value-based payment that rewards better patient outcomes and lower costs is key to getting more value for the $3.3 trillion spent annually on U.S. health care. The ACO model is a market-based solution to fragmented and costly care that encourages local physicians, hospitals, and other providers to work together and be responsible for improving quality, enhancing patient experience, and reducing waste to keep care affordable while maintaining patient choice.

The MSSP is the largest value-based payment model in the United States, growing to 561 ACOs with more than 350,000 providers caring for 10.5 million Medicare beneficiaries in 2018. Under current MSSP rules, new ACOs are eligible to share savings with Medicare for up to six years if they meet quality and spending goals but are not at financial risk for any losses.

Despite the growing ACO track record of improving quality and saving Medicare money, CMS, in an August 17 proposed rule, moved to shorten the time new ACOs can remain in the shared-savings-only model from the current six years to two years. Data show ACOs need more than two years to begin showing the benefits of forming an ACO. That proposal, coupled with CMS’s move to cut shared savings in half — from 50 percent to 25 percent for shared-savings-only ACOs — would deter new Medicare ACOs from forming.

“It takes time and money to transform entrenched care delivery practices in local communities and build the critical mass to successfully integrate care, manage risk, and improve quality while reducing spending growth,” said Stephen Nuckolls, CEO of Coastal Carolina Quality Care in New Bern, N.C., which includes 63 providers caring for 11,000 Medicare beneficiaries. “Unfortunately, the proposed changes will hold up the move to value-based care by significantly undermining the business case to voluntarily form new Medicare ACOs.”

Gaus said the ultimate goal of the final rule should be to strike a reasonable balance of risk and reward that will encourage new ACOs to form and begin the transition to value-based payment, adding, “If successful, millions more Medicare beneficiaries will benefit from better care and lower costs while maintaining the choice to see any Medicare provider they want.”

NAACOS encourages CMS to: